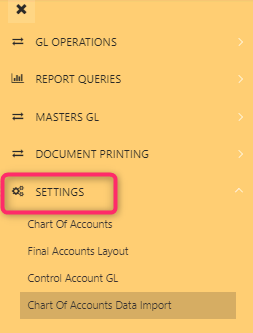

SETTINGS

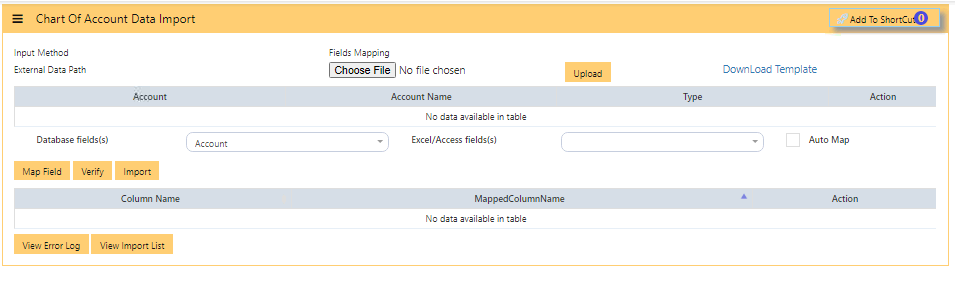

SETTINGS in UNIQ365 consists of CHART OF ACCOUNT, FINAL ACCOUNTS LAYOUT, CONTROL ACCOUNT GL and CHART OF ACCOUNTS DATA IMPORT.

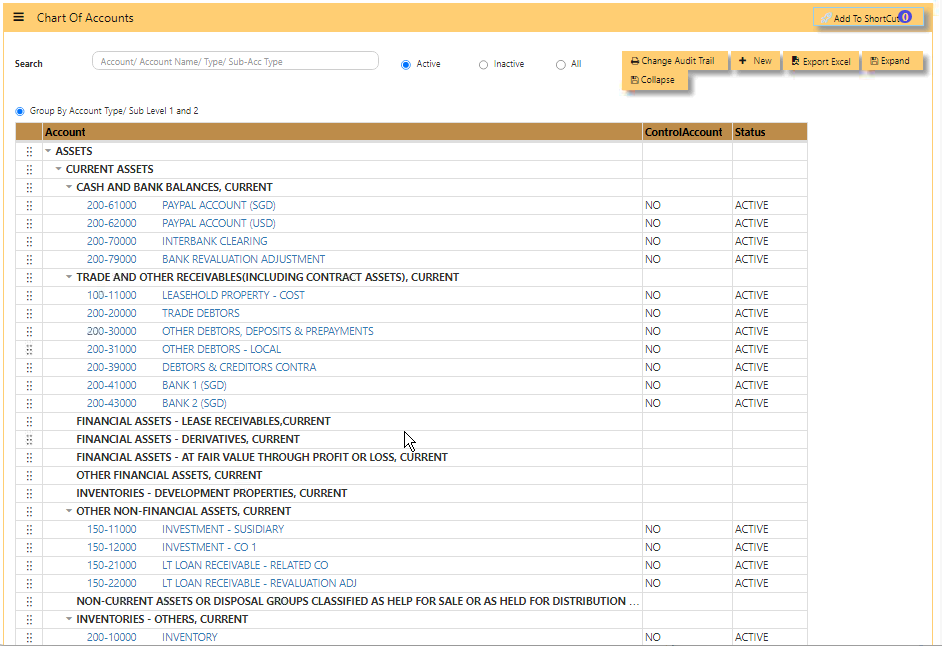

CHART OF ACCOUNTS

The Chart of Account is where the user can create account codes to be used in the system. The account codes can be classified into Assets, Liabilities, Income or Expense, as well as be grouped into various levels when designing layout of financial reports such as Balance Sheet.

In order to start using Uniq365, some basic Chart of Accounts such as the GST and Currency Codes must be created.

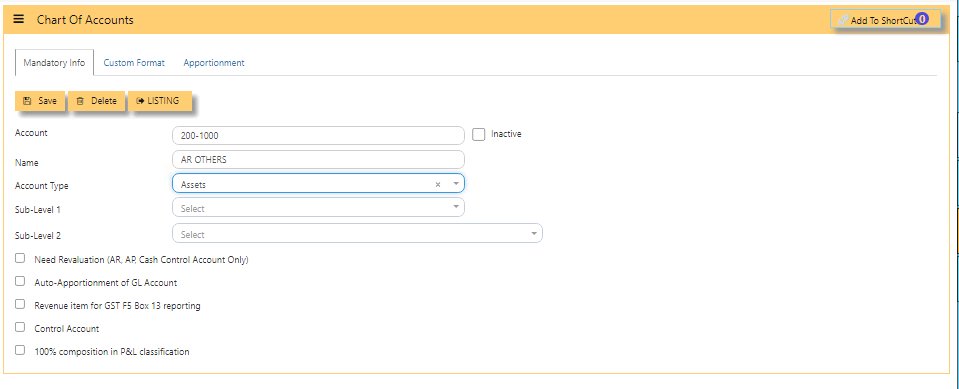

How to Createadd a Chartnew ofChart-of-Account Account?code?

-

ACCOUNT - Enter a code for this Chart of Account. The maximum is 12 alpha-numeric characters.

-

NAME - Enter the description for this Chart of Account e.g. Sales Revenue Account. The maximum length allowed is 40 characters.

-

ACCOUNT TYPE - Click to select account type. The 4 choices are Income, Expense, Asset and Liability

- SUB-LEVEL 1 - used in P&L presentation

- SUB-LEVEL 2 - used in P&L presentation

- NEED REVALUATION [AR, AP, CASH CONTROL ACCOUNT ONLY - when ticked, the specific coa will be included in the revaluation of AR or AP.

- AUTO-APPORTIONMENT OF GL ACCOUNT -

- REVENUE ITEM FOR GST F5 BOX13 REPORTING - when ticked, will include in BOX 13, applied to income coa,

- CONTROL ACCOUNT-applies to AR and AP main chart of account,

- 100% COMPOSITION IN P&L CLASSIFICATION- applied to main income chart of account.

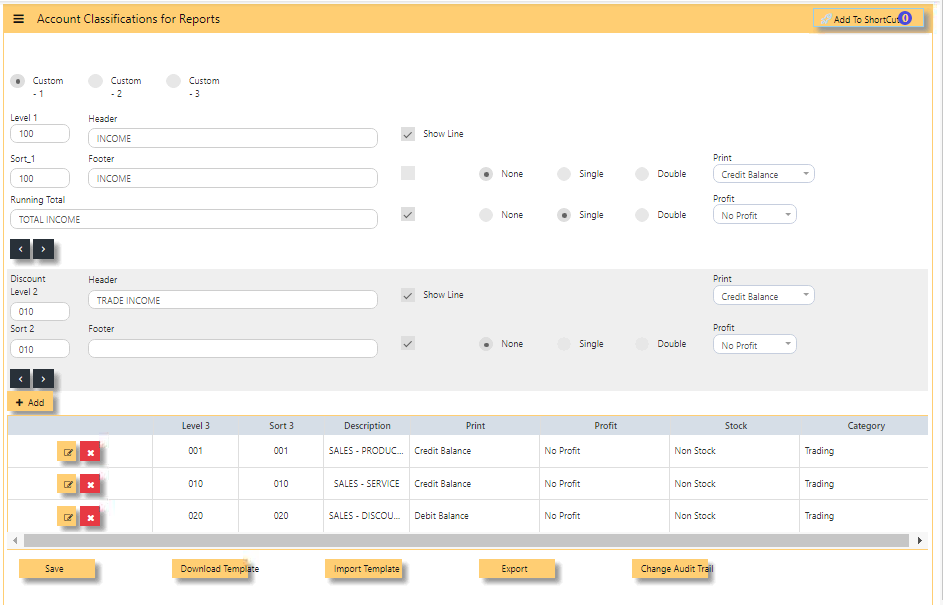

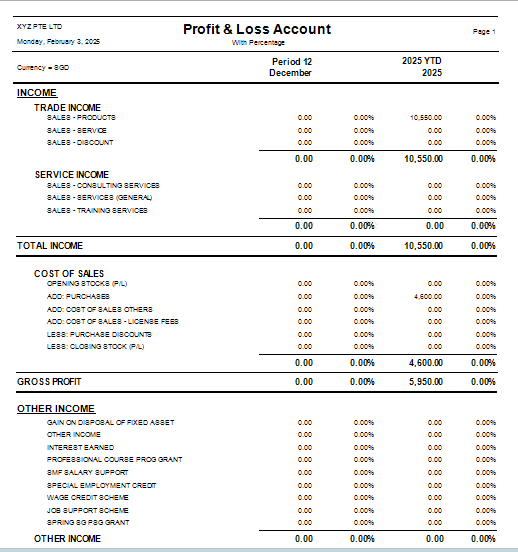

FINAL ACCOUNTS LAYOUT

Uniq365 allows almost unlimited ways to display your Profit & Loss Statement and Balance Sheet layout. This module will help to manage the Profit and Loss classification and Balance sheet classification.

- There are 3 custom format available for user to re-design reports - custom 1, 2 and 3.

- LEVEL 1, LEVEL 2 - are branches of Level 1 account, while LEVEL 3 - are branches of Level 2 account, key in your preferred description,

- SORT 1 _ FOOTER - key in the description,

- SHOW LINE - will provide underline, can be none, single line or double lines.

- PROFIT - to show if the account is in normal credit balance or debit balance.

- RUNNING TOTAL under LEVEL 1 - sums up the total of Level 1.

- +ADD - to add each account code corresponding chart of account.

- LEVEL 3_ SORT 3 - key in description, select print, select profit, select non stock and category trading.

- SAVE - tick will save any new addition or changes.

- DOWNLOAD TEMPLATE - to get template in excel format for filling up,

- IMPORT TEMPLATE - to forward to system the prepared template,

- EXPORT - to export in excel format.

- CHANGE AUDIT TRAIL-provide report of latest change done by user.

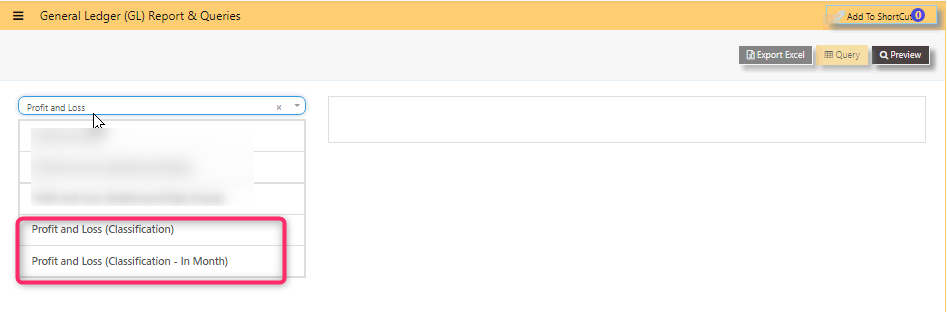

How to get the classification report?

- In General ledger,

- reports queries,

- Profit and loss classification or,

- Profit and loss classification in month.

- Balance sheet classification

- Balance sheet

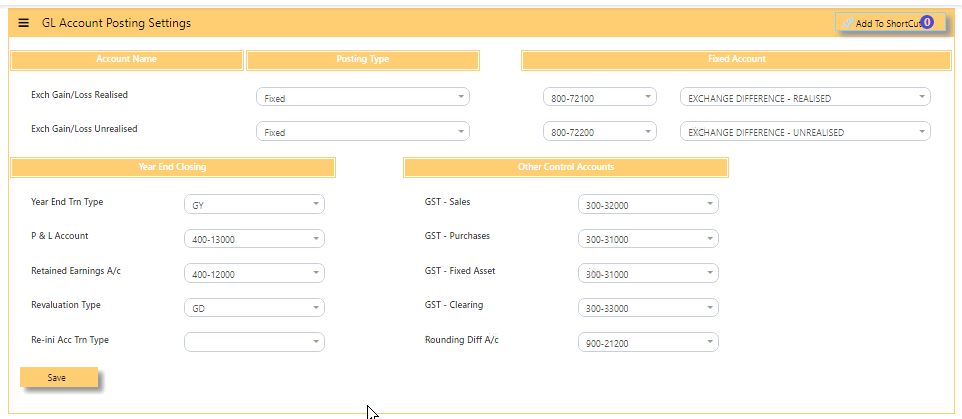

CONTROL ACCOUNT GL

In UNIQ365, this option determines how the GL is updated when posting transactions. For example, the Chart of Account to be posted for Exchange Gain/Loss or GST tax depends on what has been selected for the respective account as shown below example-