MASTER GL

GST TYPE

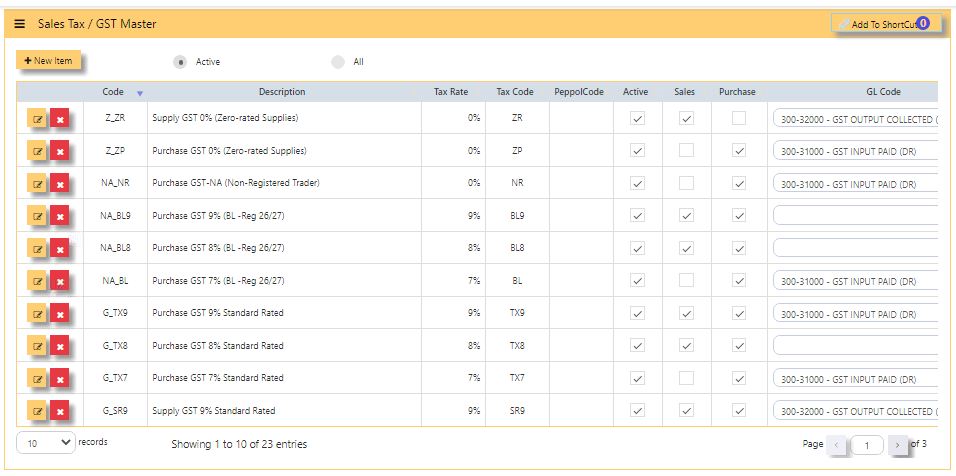

GST TYPE or SALES TAX / GST MASTER in UNIQ365 are pre-set codes and not interchangeable.

- Note that the pre-set codes are based on the prevailing IRAS codes.

- If there is any new rates advised by IRAS, it will be added accordingly and you should not manually add.

-

What to do when GST Rates Change? The UNIQ365 is able to cope with the changes of rate and is readily available.

- CODES is pre-set codes and cannot be interchangeable,

- DESCRIPTION is also pre-set codes but can be changed,

- TAX RATE is pre-set rate,

- TAX CODE is pre-set codes base on prevailing IRAS codes,

- PEPPOL CODE is for peppol use,

- ACTIVE is ticked if actively use,

- SALES is ticked if the code is used for sales only,

- PURCHASE is ticked if the code is used for purchases only,

- GL CODE is chart of account mapped for the specific gst code.

PROJECT

(*) - This is an optional module. If you have not sign up for it, you will not see this on your menu.

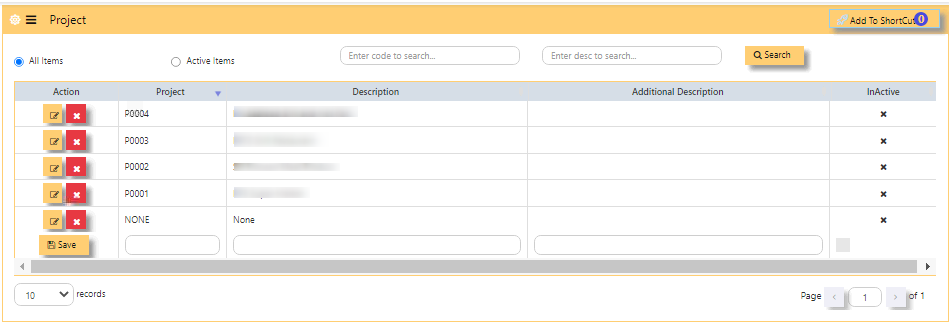

Project Accounting in UNIQ365 is achieved by the use of PDSU Codes, available throughout the entire package. Understanding what the PDSU codes will enable you to set it up most appropriately.

Project Code

“P” refers to Project Code; an 8-character field, that can be used to signify different projects, different offices or even different business units.How to add project?

- Beside 'SAVE' button, PROJECT - key in unique code,

- key in DESCRIPTION-this field is interchangeable,

- optional ADDITIONAL DESCRIPTION [also interchangeable] ,

- column 'INACTIVE' COLUMN shows inactivated projects.

- after filling, tick SAVE.

- EDIT BUTTON - note that if the project is already used in transactions, system will not allow you to change anymore.

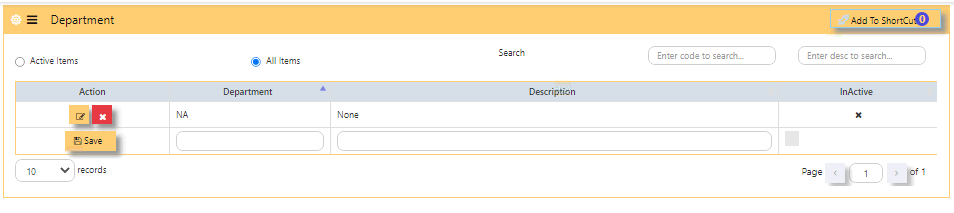

DEPARTMENT

Department Code

“D” refers to Department Code; an 8-character field, that can be used to signify sub-group under defined 'P' such as branches or the like.

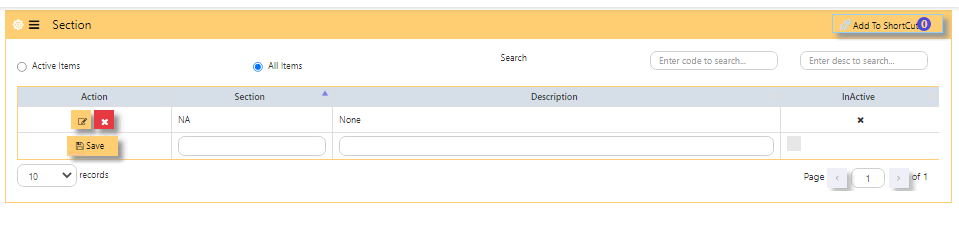

SECTION

Section Code

“S” refers to Section Code; an 8-character field, that can be used

to signify sub-group under 'D'.

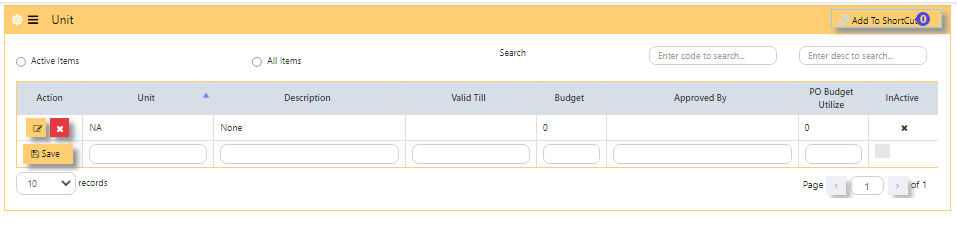

UNIT

Unit Code

“U” refers to Section Code; an 8-character field, that can be used

to signify sub-group under 'S'.

How does PDSU Works?

Every transaction can carry the PDSU at entry. The reports in General Ledger – Reports & Queries allow you to filter by PDSU

It also allows a combination of PDSU codes to work, thus narrowing the reporting band.

For example:

How to Use PDSU for Budgeting?

Accounts budgeting in UNIQ365 requires the use of PDSU. To set budgets, go to Maintenance – Account Budget to start

entering the budgets.

- Select the GL Account to set budget.

- Enter the Year. If the financial year is from 1st Jan 2027 -

31st Dec 2027, enter the year as 2027 and January will be

Month 1, February is Month 2 and so on - At the first line (Month 1), click on “Details” to get into

entry mode as follow. - Select an appropriate Project, Department, Section and Unit Code to

start the budgeting process. - When this budget detail box is closed, the totals of all the

individual budgets auto-updates into the Month 1 balance.

Move on into Month 2 and so on until all the 12 months’

budgets are set. Move on to the next GL code.

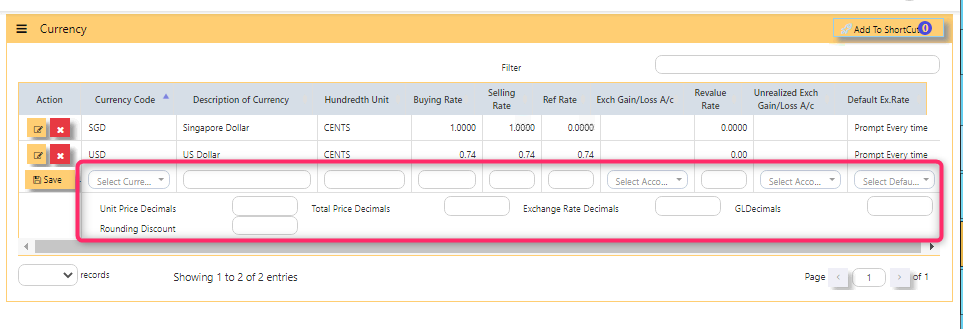

CURRENCY

Currencies needed for transactions are created in this table.

Note: If you did not buy the multi-currency option in UNIQ365, you can only create a single currency.

How to Create a New Currency?

- In the open field, SELECT CURRENCY,

- as you select the 'CURRENCY', DESCRIPTION OF CURRENCY will auto-fill,

- same on HUNDREDTH UNIT, will auto-fill,

- manually key in BUYING RATE,

- manually key in SELLING RATE,

- manually key in REF RATE,

- for EXCHANGE GAIN/LOSS AC, leave blank [as the GL ACCOUNT SETTING will be followed for the GL POSTING],

- manually key in REVALUE RATE,

- for UNREALIZED EXCH GAIN/LOSS AC, leave blank [as the GL ACCOUNT SETTING will be followed for the GL POSTING],

- fill UNIT PRICE DECIMALS as 2 or 4 depending on your preference if 2 or 4 decimals,

- fill TOTAL PRICE DECIMALS as 2 or 4 depending on your preference if 2 or 4 decimals,

- fill EXCH RATE DECIMALS as 2 or 4 depending on your preference if 2 or 4 decimals,

- fill GL DECIMALS as 2 or 4 depending on your preference if 2 or 4 decimals,

- fill ROUNDING DISCOUNT as 2 or 4 depending on your preference if 2 or 4 decimals.

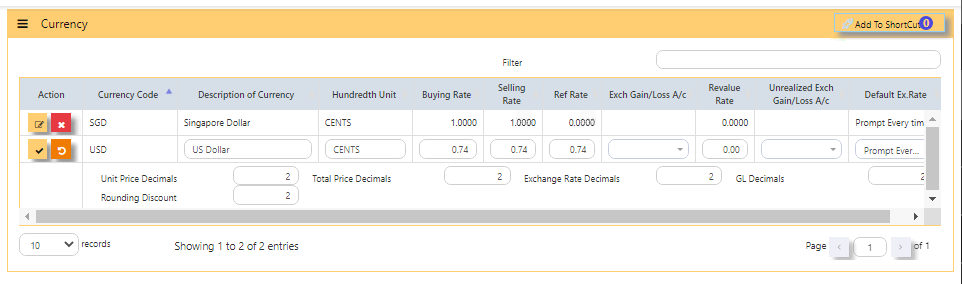

HOW TO EDIT THE RATE [SIMPLE TABLE]?

Once added, you can only edit for the exchange rates and decimals. Changes can be set at first day of accounting year.

- Click on GL – Maintenance - Currency icon.

- You can only pick up the Currency Code and you are not

allowed to create new ones. Any currency selected here is

used for all transactions in UNIQ365. - The hundredth-unit description is for UNIQ365 to print

amount in words. For example, it is “Cents” for Singapore

Dollars, “Sen” for Malaysian Ringgit, “Satang” and “Centavos”

for Thai and Filipino currencies respectively. - The Exchange GL Acct, Revalue Rate and Unrealized

Gain/Loss A/c will be skipped for now as it will be covered

under Multi-Currency Handling. -

Note: If you did not buy the Foreign Currency option, ignore the Exchange Gain/Loss options.

DAILY CURRENCY (BY CURRENCY)

In DAILY CURRENCY BY CURRENCY table, you will be able to view the daily rates by currency.

DAILY CURRENCY (BY DATE)

DAILY CURRENCY BY DATE table, in this table, KEY IN the daily rates by currency.