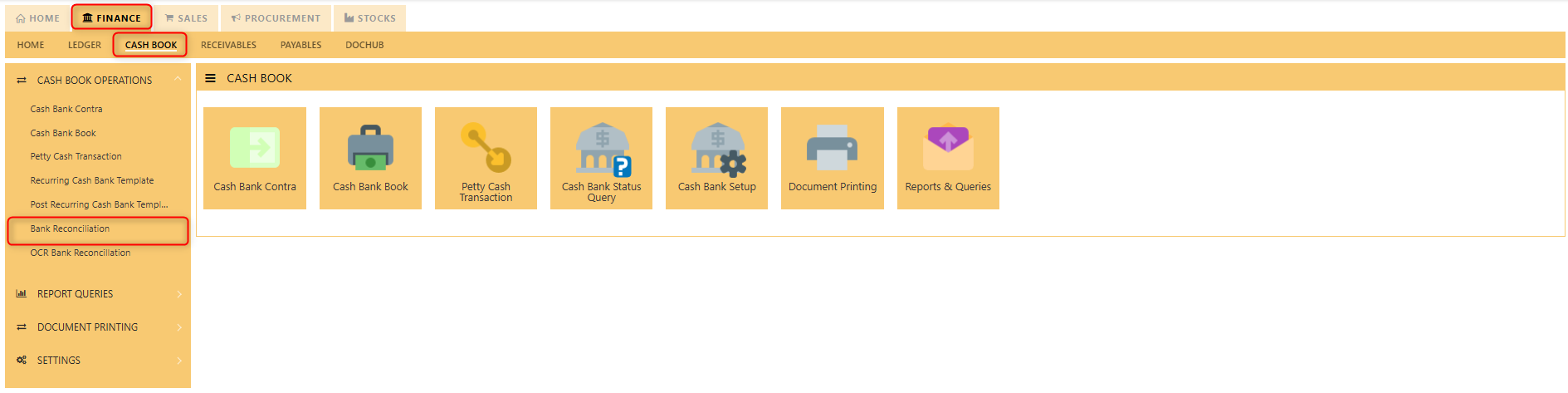

Bank Reconciliation

This is the place where you can reconcile your bank with system.

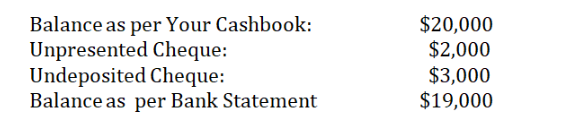

When you start a new company database, one of the figures you enter as an opening balance is the bank balance. This is not the balance as per the bank statement (unless there are no outstanding items) but is the balance per your books.

The difference between the two is usually unpresented cheques or deposits i.e. transactions that have been recorded by you but have not hit the bank statement.

Let’s use an example to illustrate the way to treat Unpresented Cheques or deposits when you start using UNIQ365:

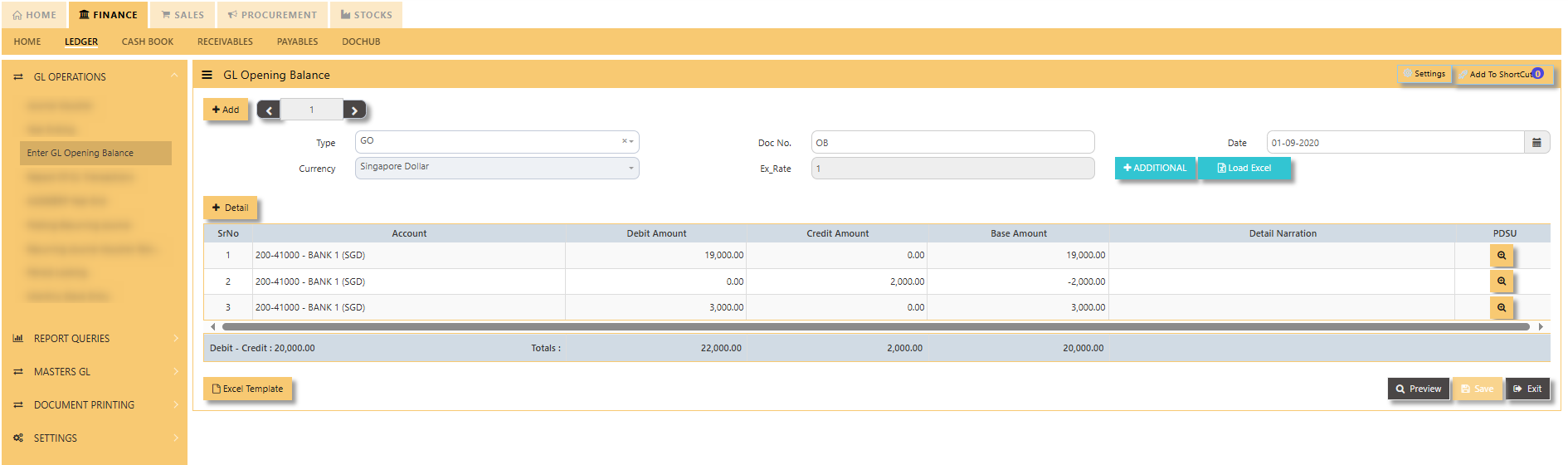

Go to GL Opening Balance option, enter your opening balances (i.e. Assets and Liabilities) as per normal but take note of the transaction for your bank. Instead of entering $20,000, you should enter the Bank opening as shown in the screen below:

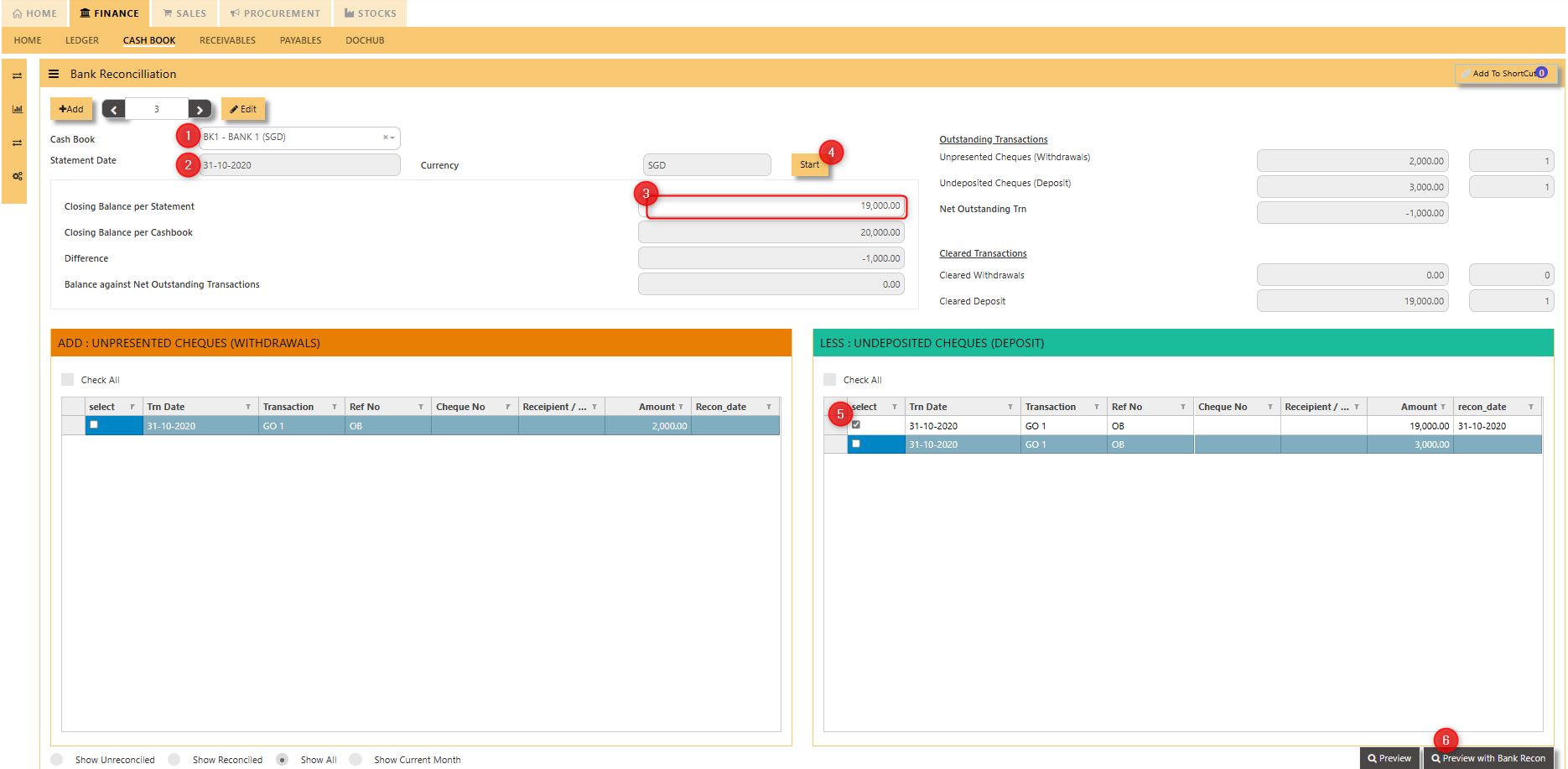

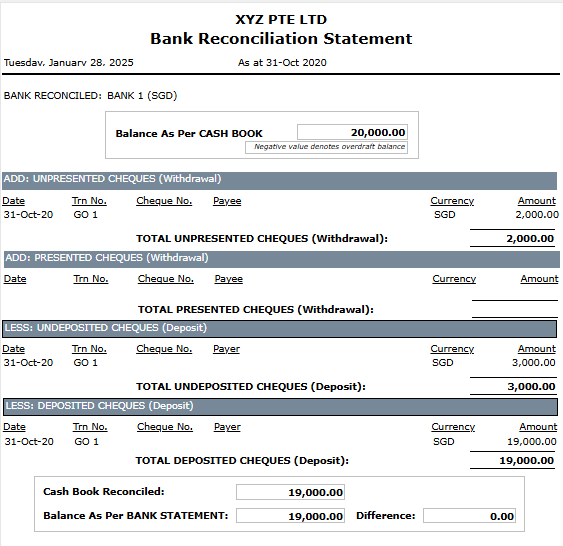

Hence, the eventual balance of your cashbook is still $20,000. Also, you will be able to see the unpresented cheques or deposits in the Bank Reconciliation screen as shown below:

- Select the bank code.

- Choose the year and period for the reconciliation.

- Key in the Closing Balance per Statement

- Click on "Start"

- Tick the line with amount as per the balance of your bank statement.

- Then, you will see the Bank Reconciliation report as follow:

This is the place where you can reconcile your bank with system.

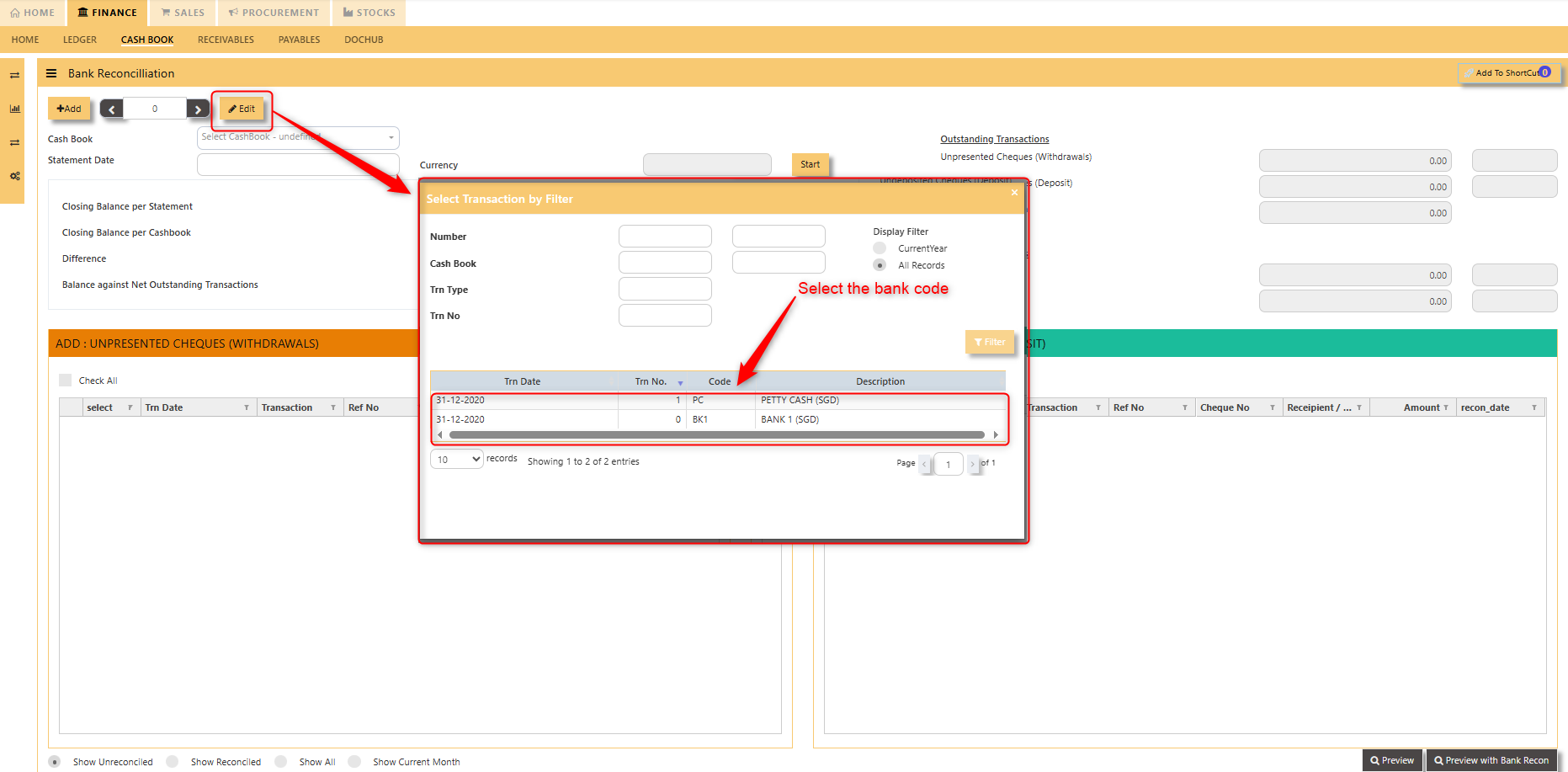

Click Edit to look for the bank code which you want to do Bank Reconciliation

After selecting the bank code, you have to choose the year and period for the reconciliation

Click View All for all the transactions related to the bank code within the period or click View Un-Recon for those which have not been reconciled within the period

Click sort by Cheque, Trans No, Ref No, Date to get the sorting

After all the steps have been done, you may do the Bank Reconciliation

Reconcile between system and the statement from each bank