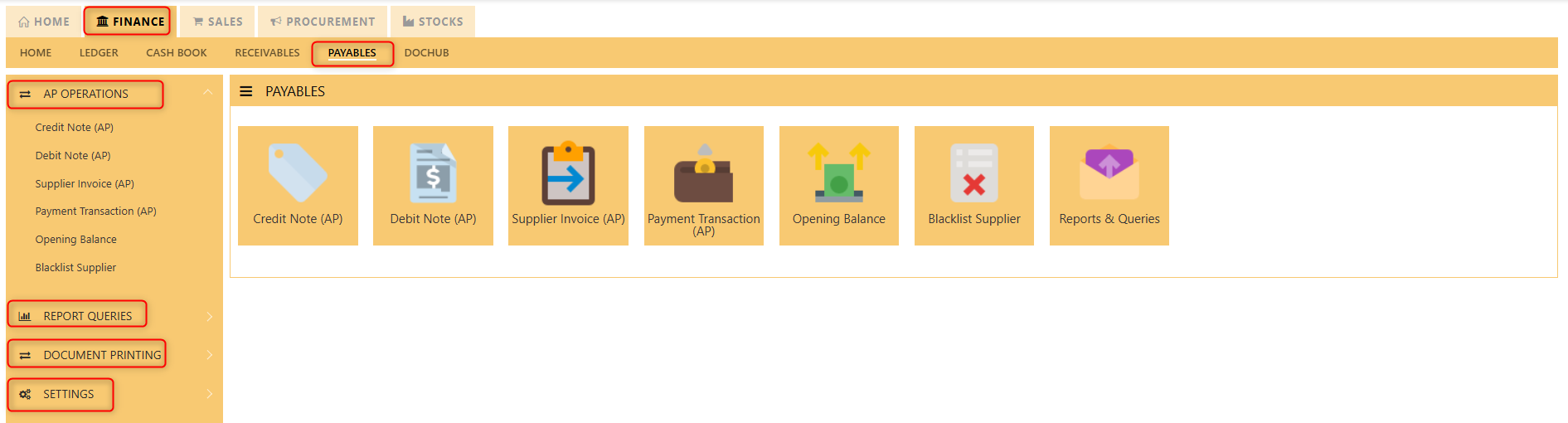

AP- OPERATIONS

AP OPERATIONS

Payable Transaction

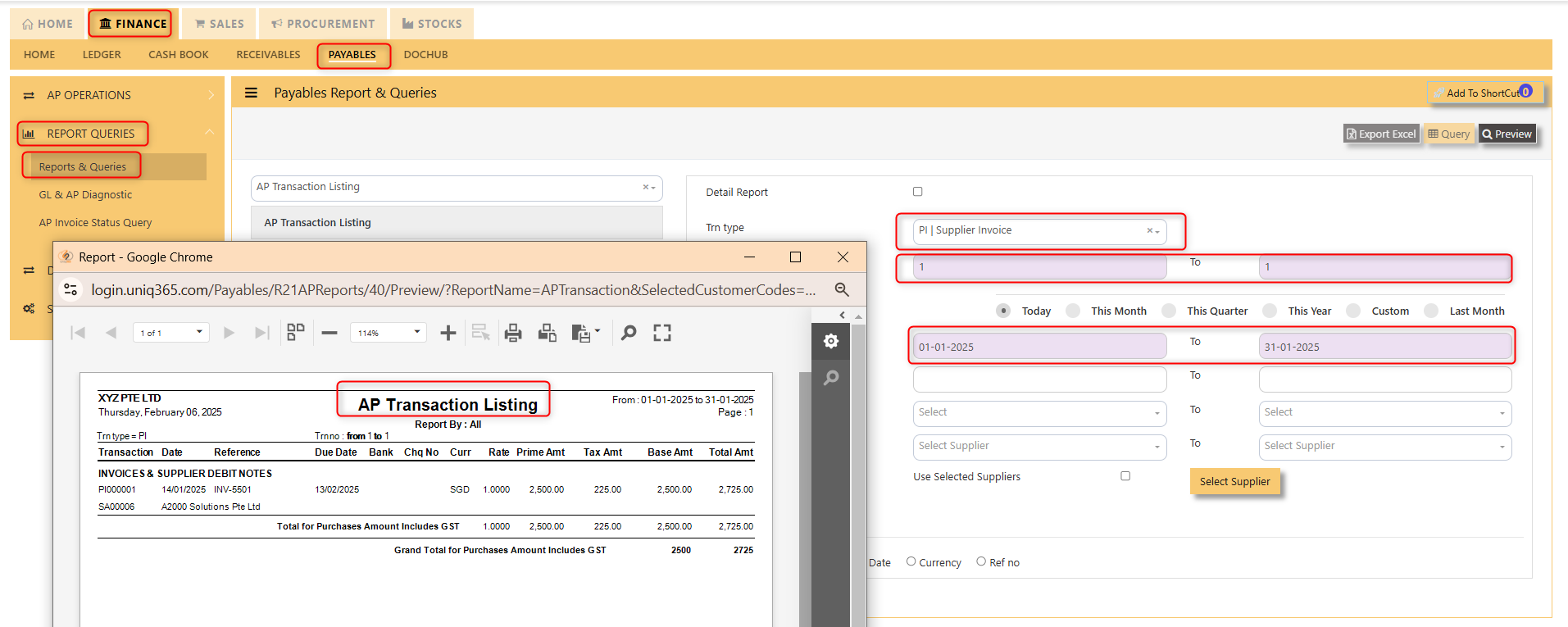

Transactions for Supplier Invoice (PI), Credit Note (PC), Debit Note (PD) and Payment transaction (PV) can be done at this option. Allocation of outstanding invoices can be made via PI, PC, PD and PV transactions.

This option posts on-line to Supplier/Creditors account and GST account if applicable. Upon allocation of foreign currency transactions, realized exchange gain/loss will be captured and its amount posted to the account concerned.

Credit Note (AP)

How to enter Credit Note (PC)?

A credit note is a document issued by a seller to a buyer, acknowledging that a certain amount of money is being credited to the buyer's account. It typically occurs when there has been a return of goods, overpayment, or an error in the original invoice. The credit note can be used by the buyer as a credit for future purchases or to request a refund.

Steps to enter PC are as follow:

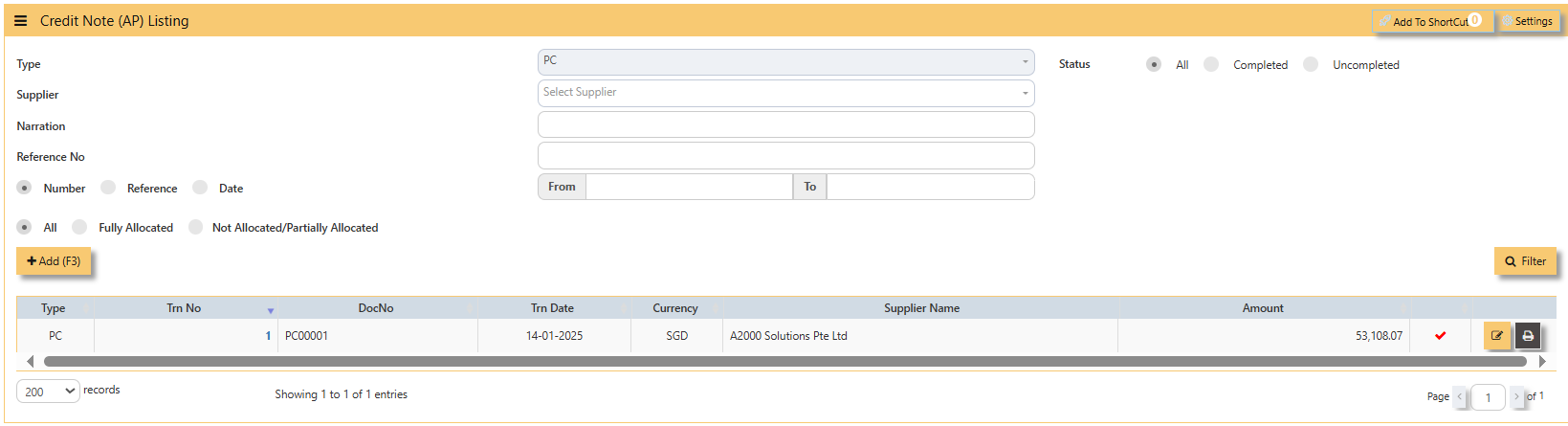

1. Click on Payables – AP Operations – Credit Note (AP) and the following screen will appear.

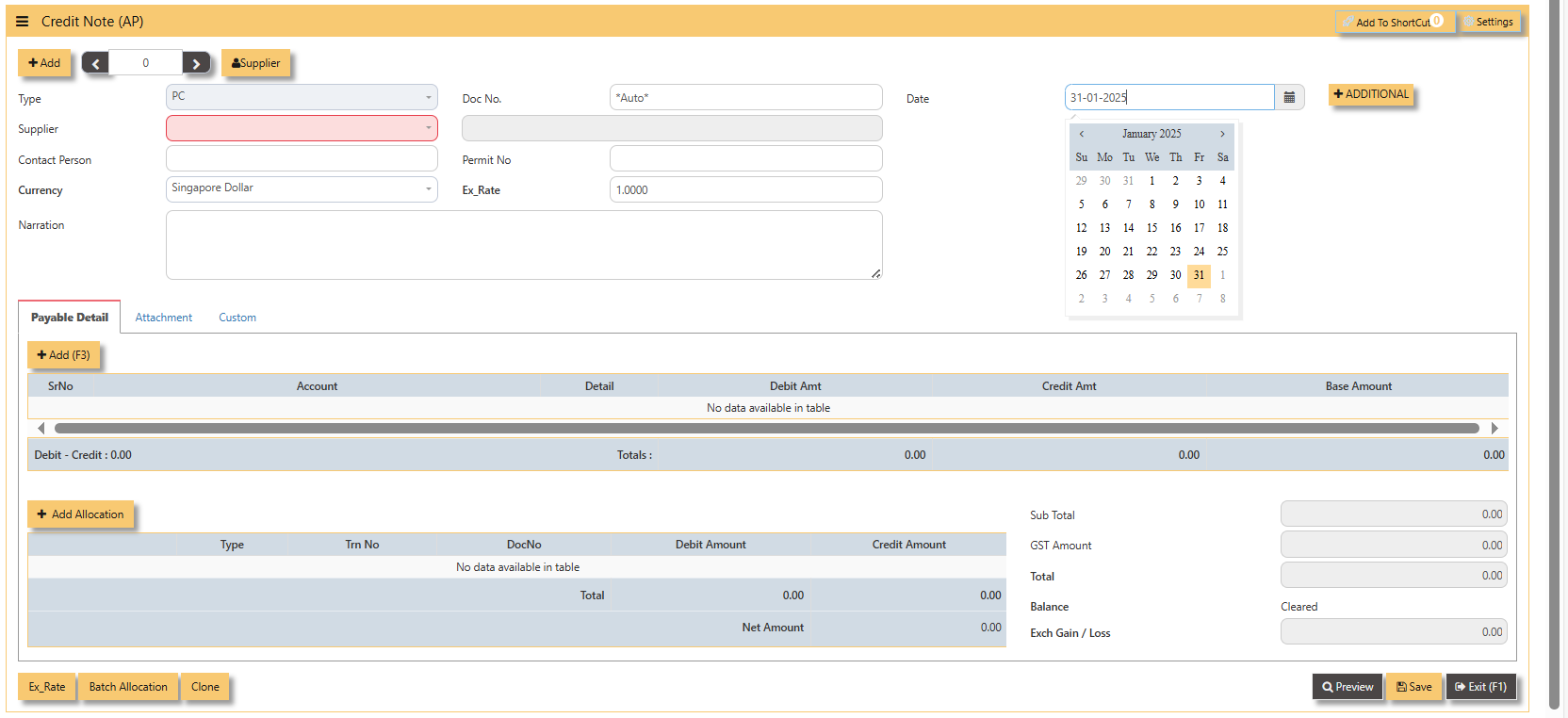

2. Click on Add button to create a new transaction.

- Fill up the fields in the header section such as Date, Supplier, Contact Person, Currency and Exchange Rate.

- Then select the account concerned at the detail section.

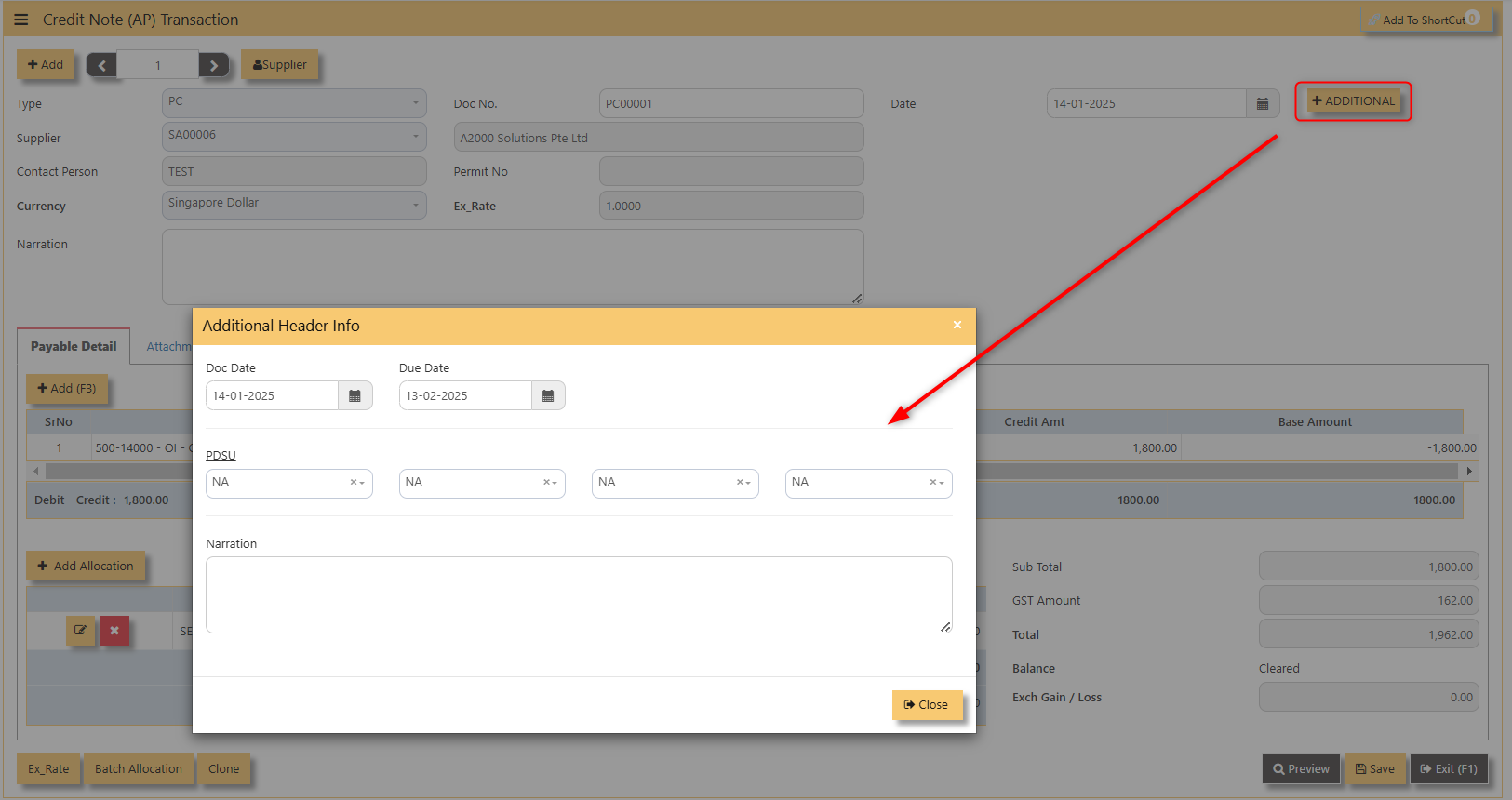

- Click for Additional Info for necessary details to add

- Click on save button to complete the entry.

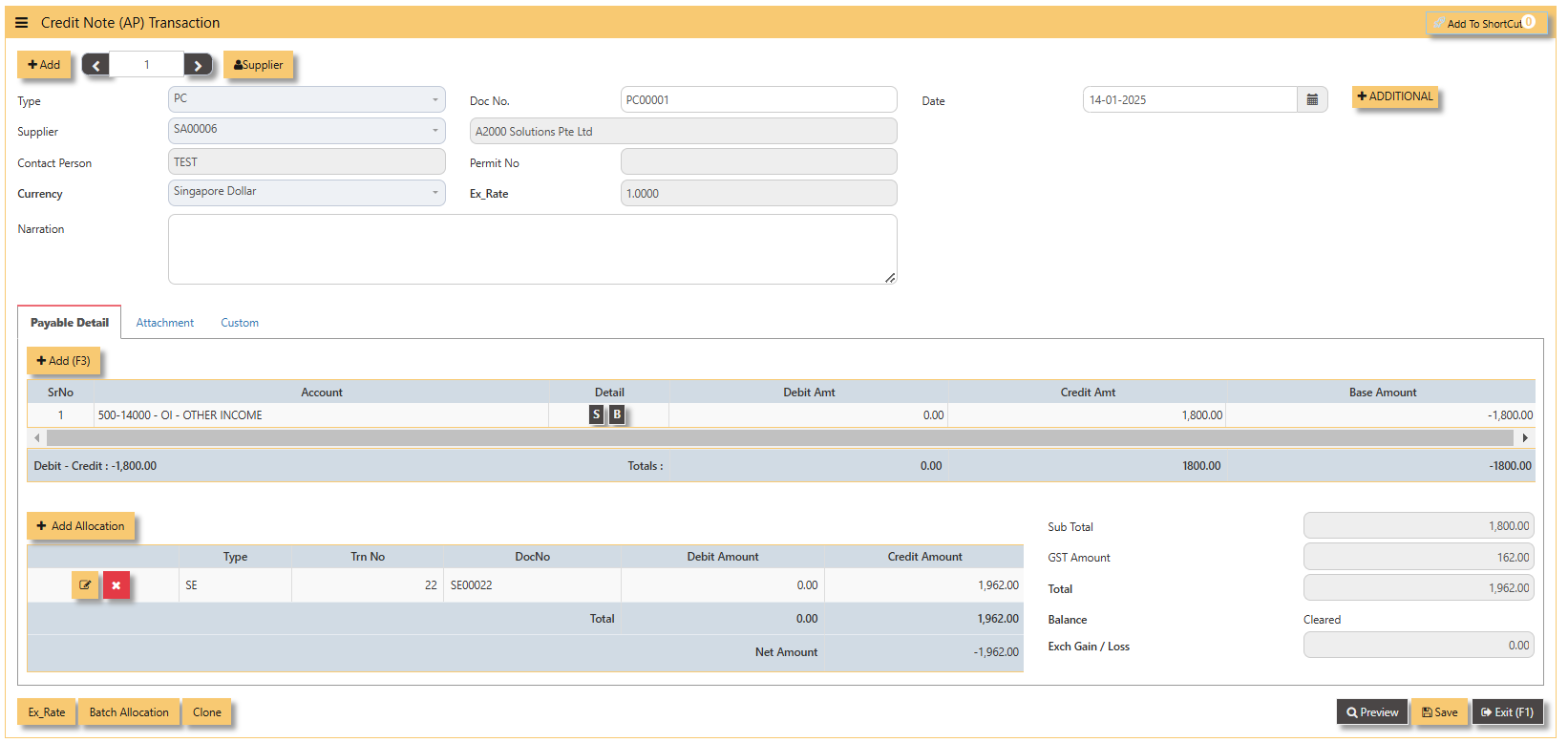

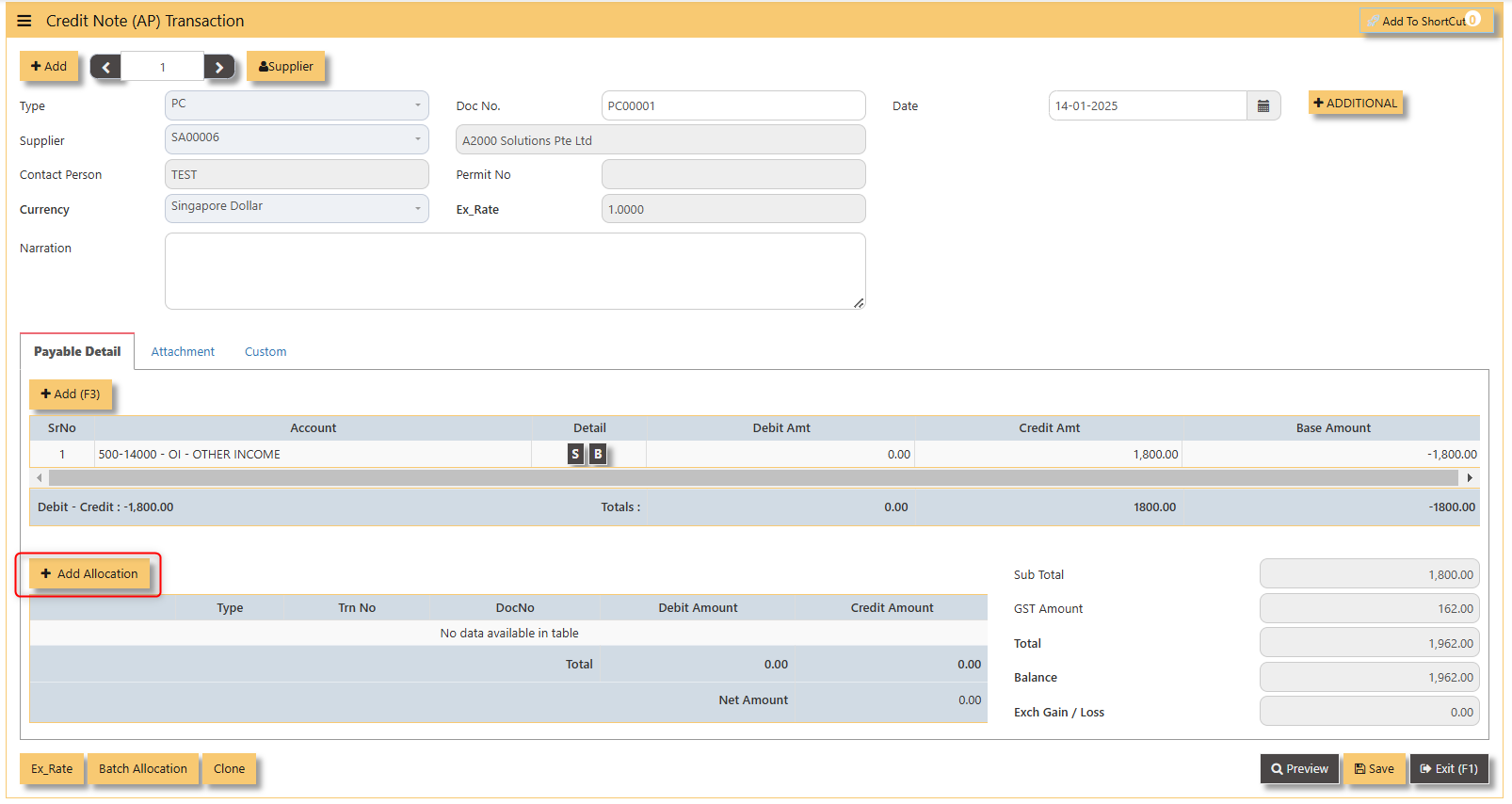

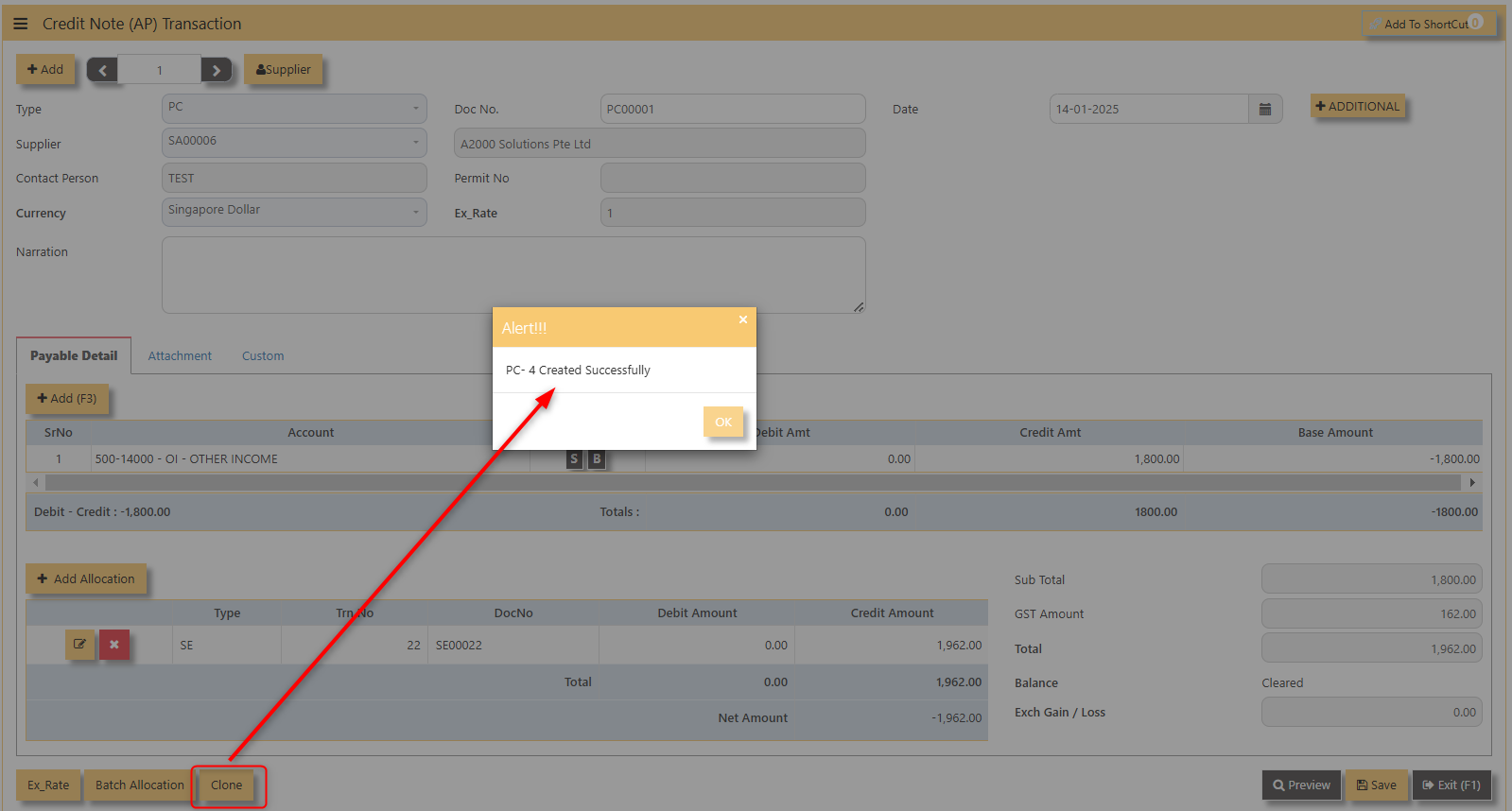

3. Below is a sample PC transaction screen.

Additional Information:

- Add Allocation This is where you can manually add allocation.

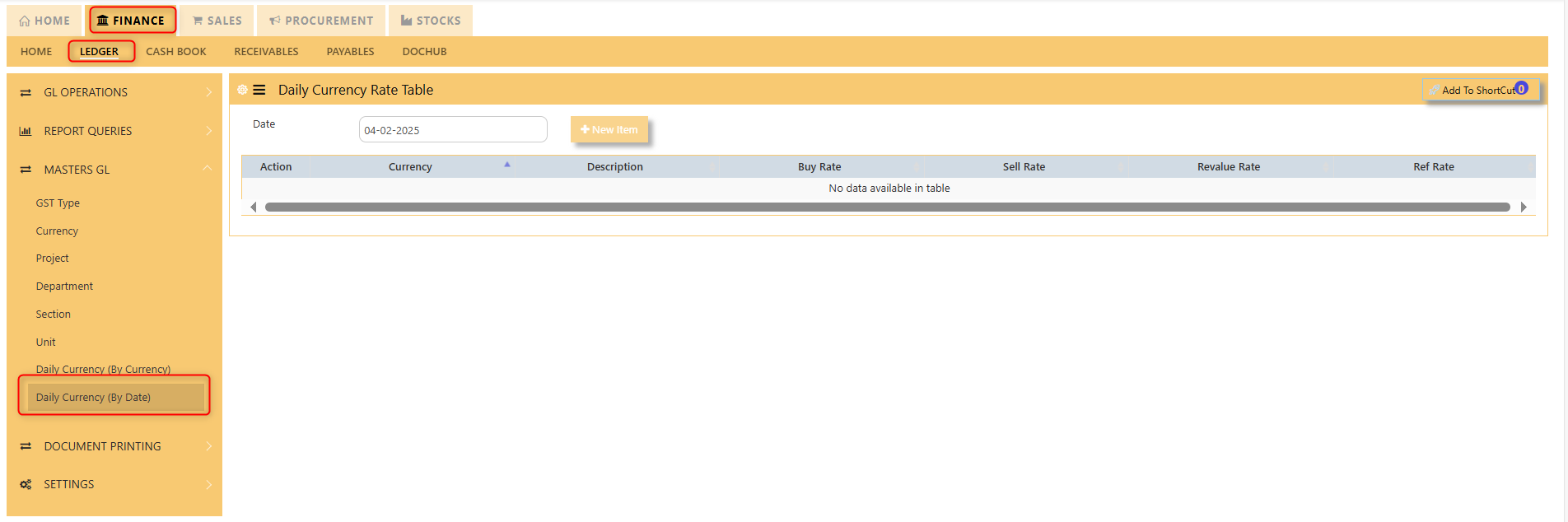

- Ex Rate It will redirect you to Finance Tab. Attached link for further information. MASTERS GL | Support Doc

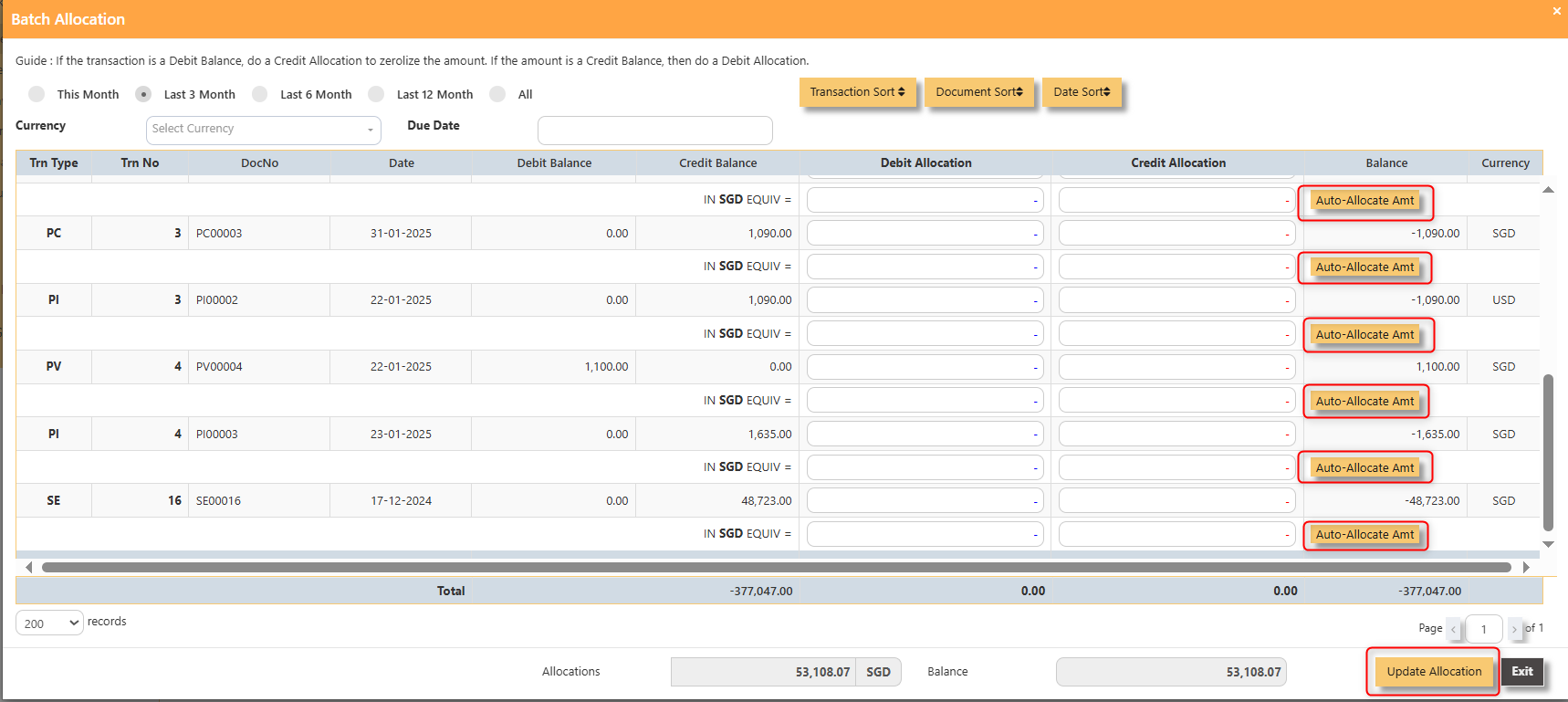

- Batch Allocation If you have a lot of transactions needed to allocate, you may use the batch allocation button to allocate transactions in a convenient way. Sample below.

- CLONE It will allow you to copy the exact transaction created; where it will be creating another transaction copying the transaction you have clone.

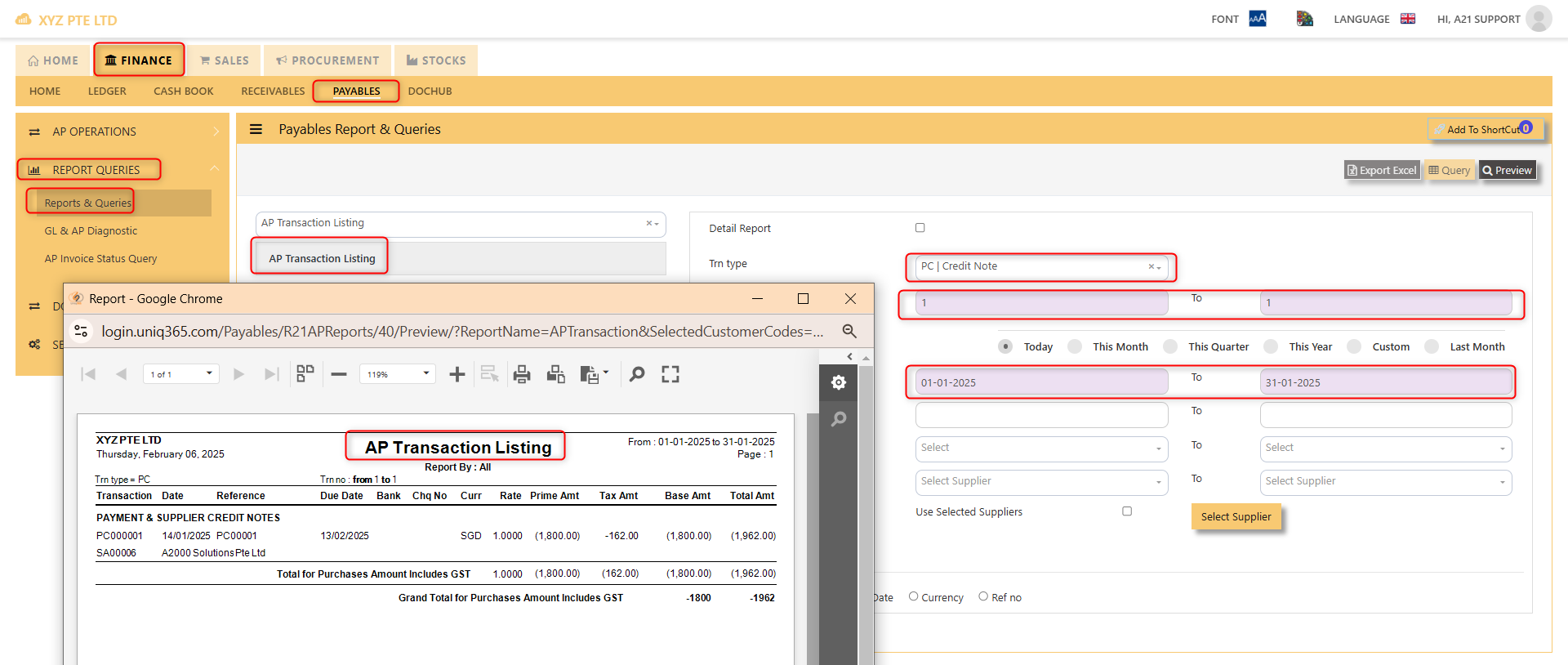

4. For the double entries of the PC transaction created, it can be verify under AP Transaction Listing.

Note: The steps to enter Credit Note (PC) & Debit Note (PD) are identical to PI. User will need to select transaction type PC or PD respectively to enter the record.

Debit Note (AP)

How to enter Debit Note (PD)?

A debit note is a document issued by a buyer to a seller, indicating that the seller owes a credit for goods or services that were returned, damaged, or invoiced incorrectly. It serves as a formal request for an adjustment in the payment, reducing the amount owed to the seller. Debit notes are commonly used in transactions to correct billing errors or return goods after delivery.

Steps to enter PD are as follow:

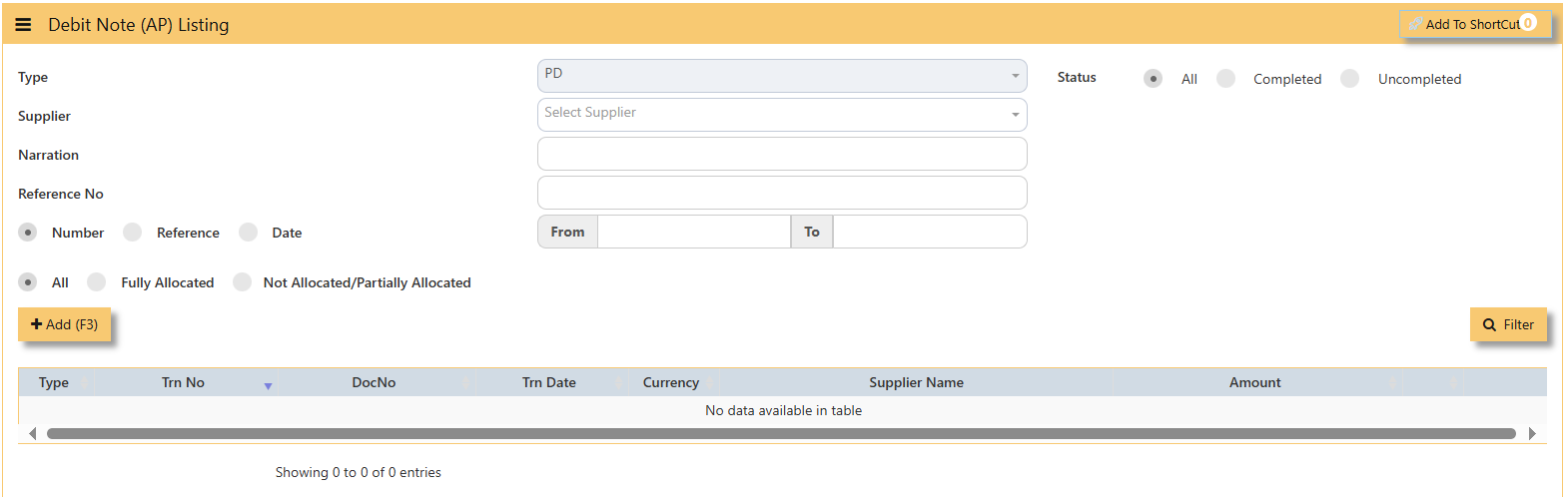

1. Click on Payables – AP Operations – Debit Note (AP) and the following screen will appear.

2. Click on Add button to create a new transaction.

- Fill up the fields in the header section such as Date, Supplier, Contact Person, Currency and Exchange Rate.

- Then select the account concerned at the detail section.

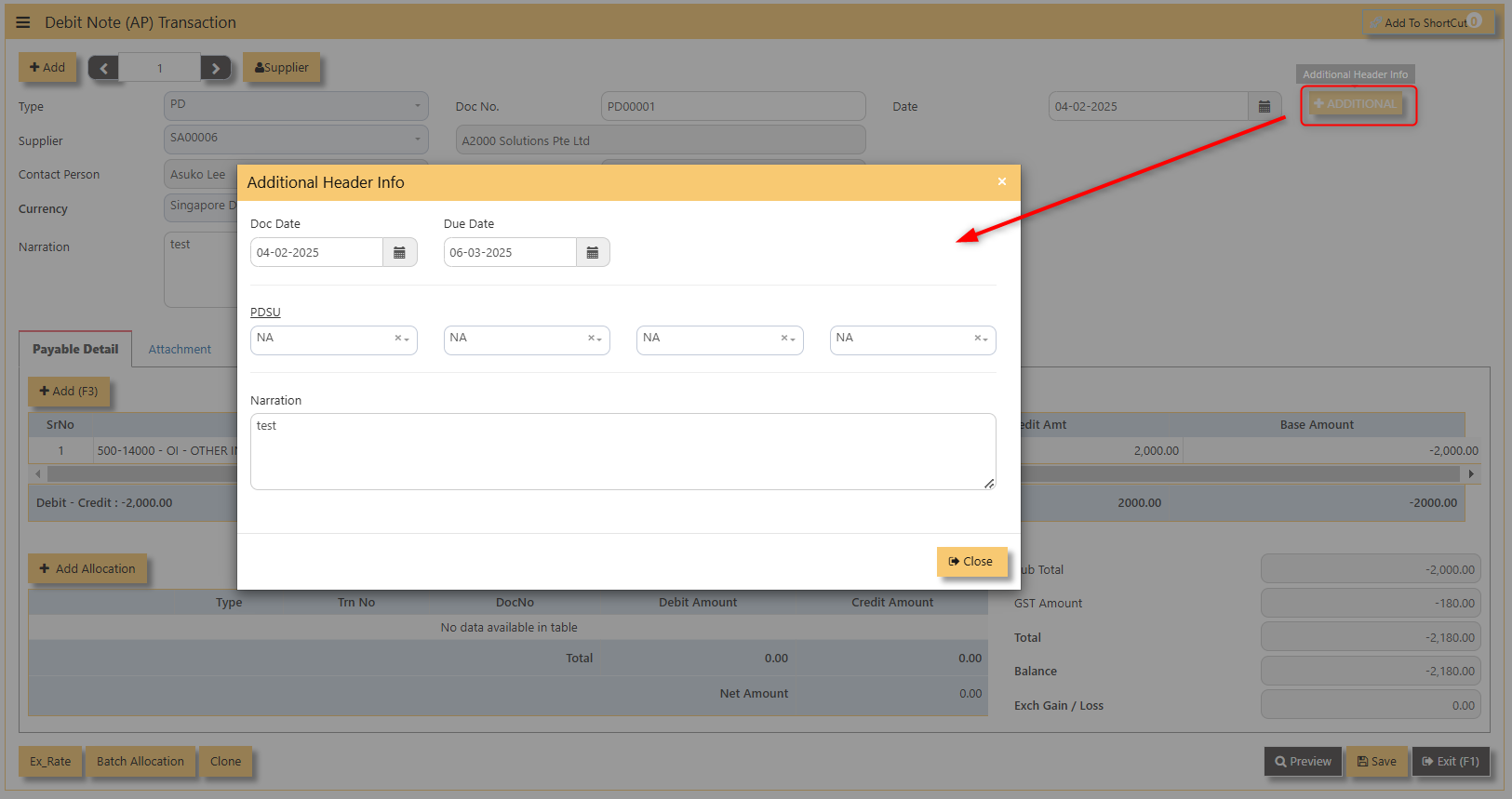

- Click for Additional Info for necessary details to add.

- Click on save button to complete the entry.

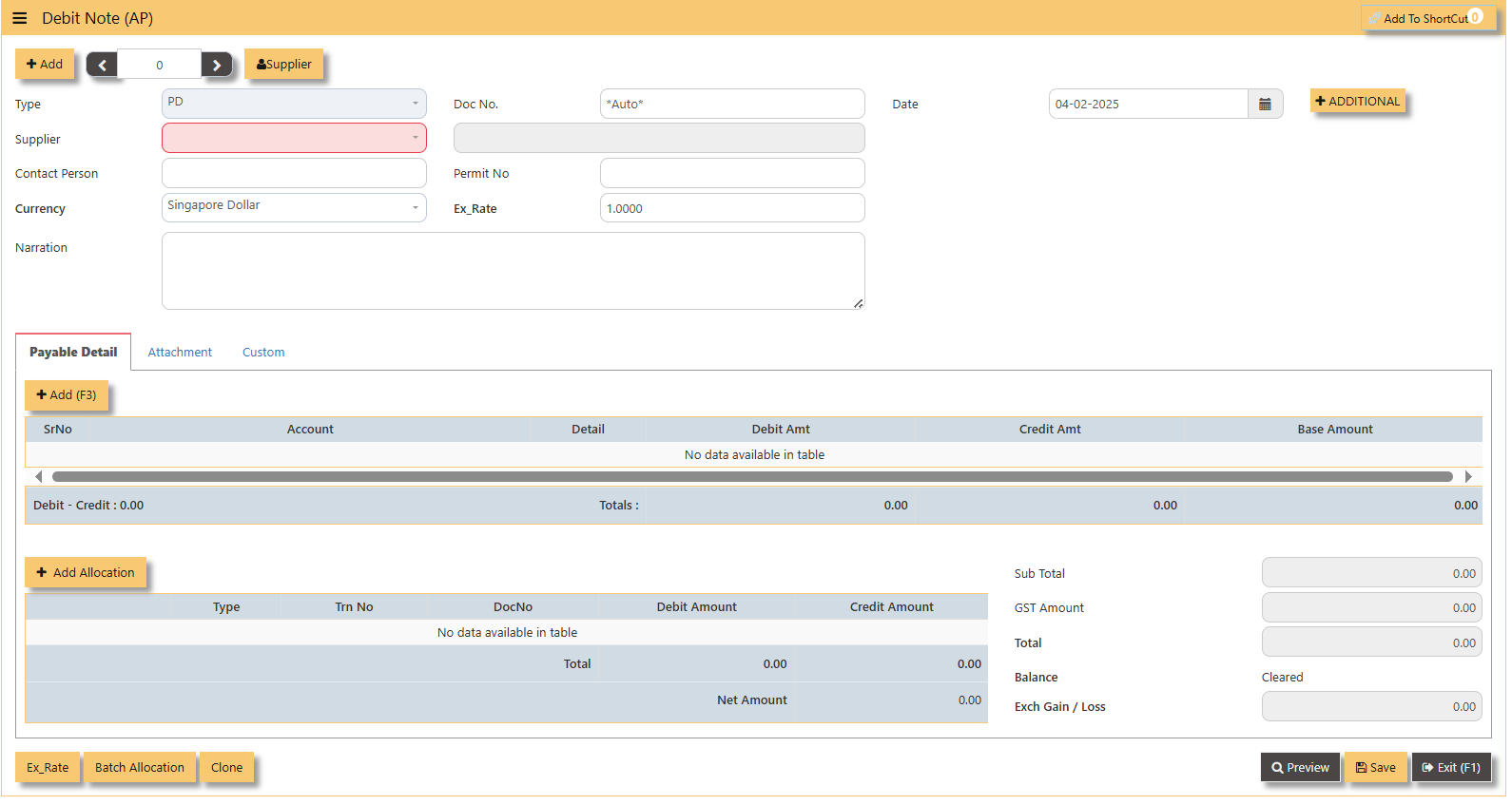

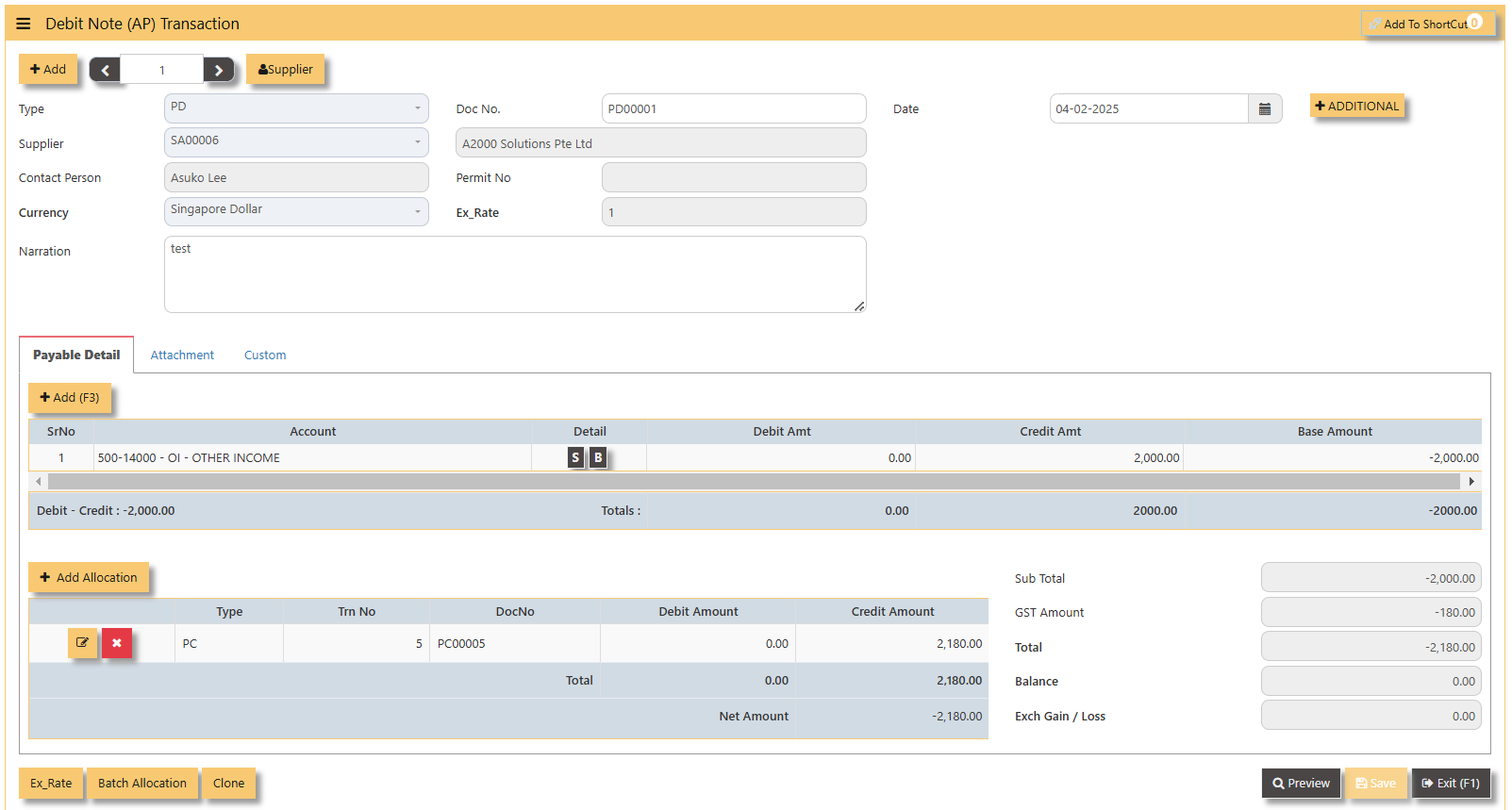

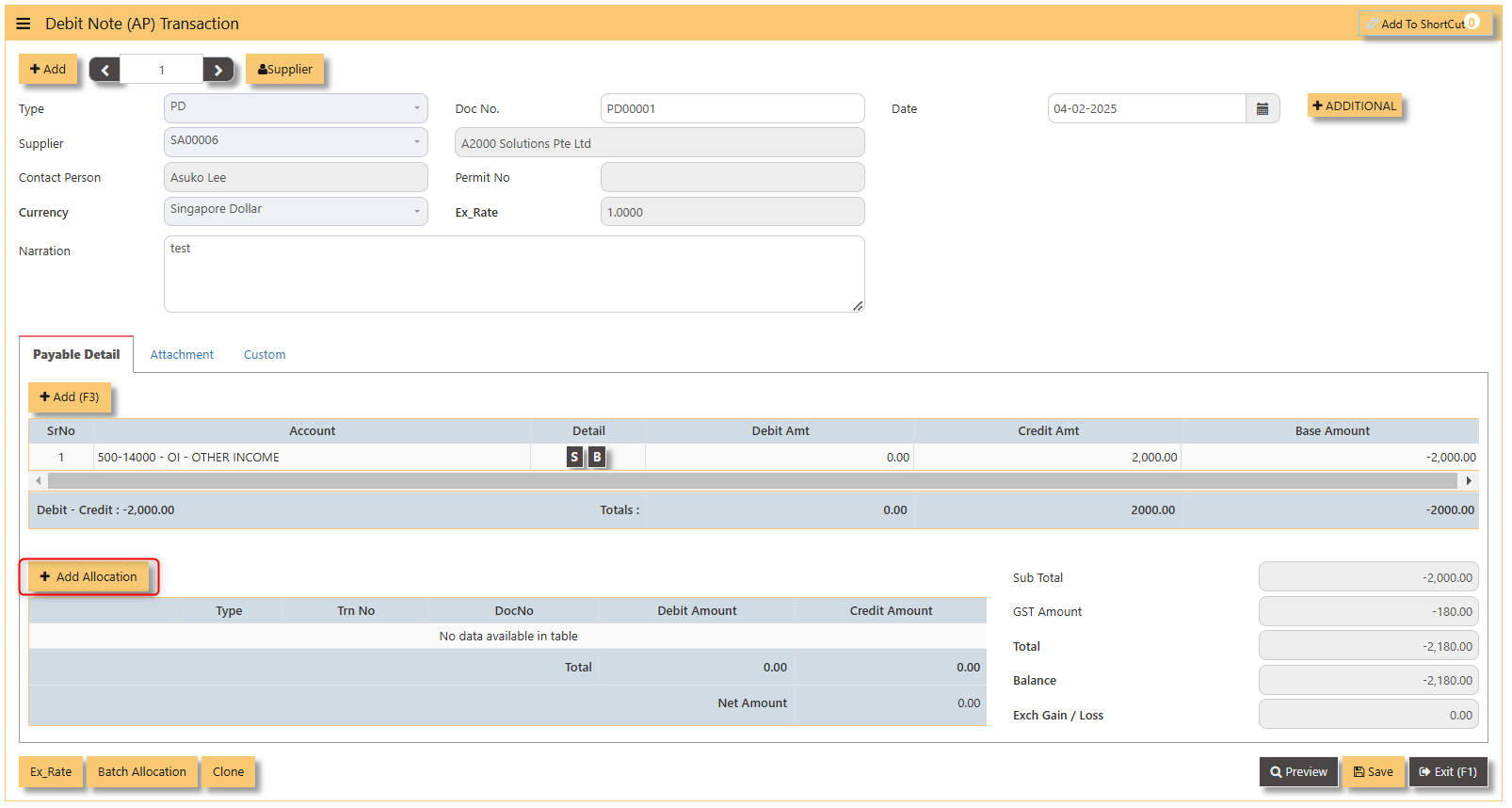

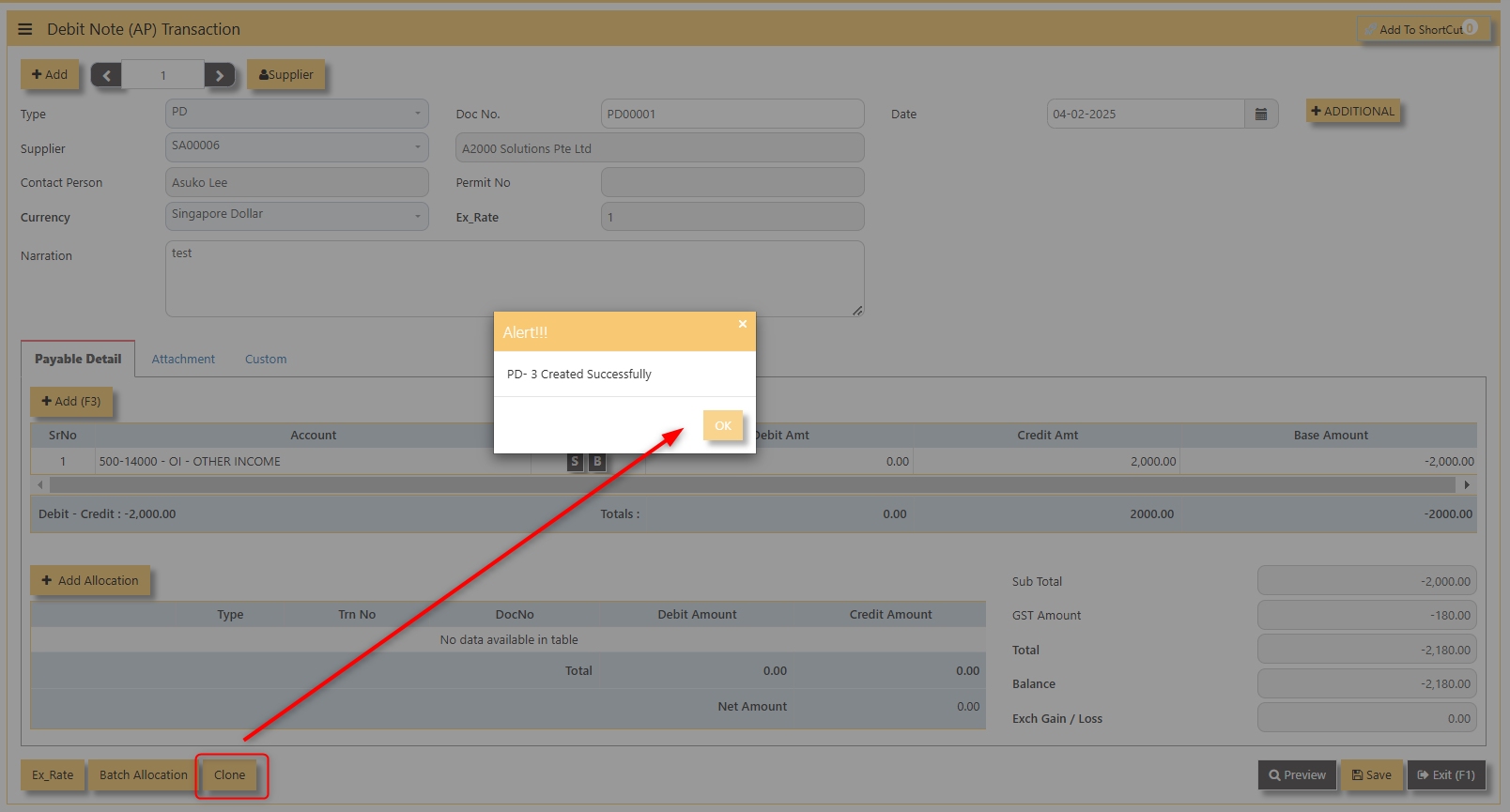

3. Below is a sample PD transaction screen.

Additional Information:

- Add Allocation This is where you can manually add the transaction.

- Ex Rate It will redirect you to Finance Tab. Attached link for further information. MASTERS GL | Support Doc

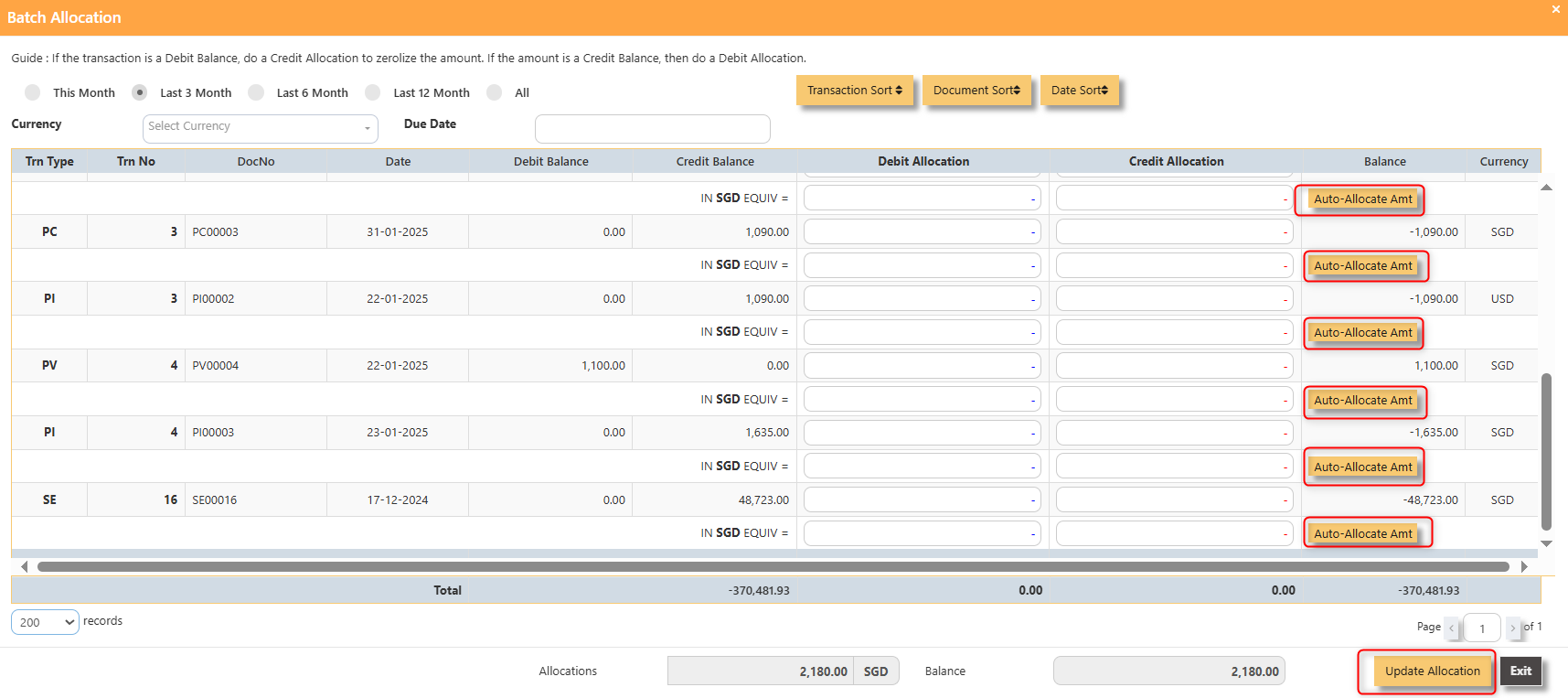

- Batch Allocation If you have a lot of transactions needed to allocate, you may use the batch allocation button to allocate transactions in a convenient way. Sample below.

- Clone It will allow you to copy the exact transaction created; where it will be creating another transaction copying the transaction you have clone.

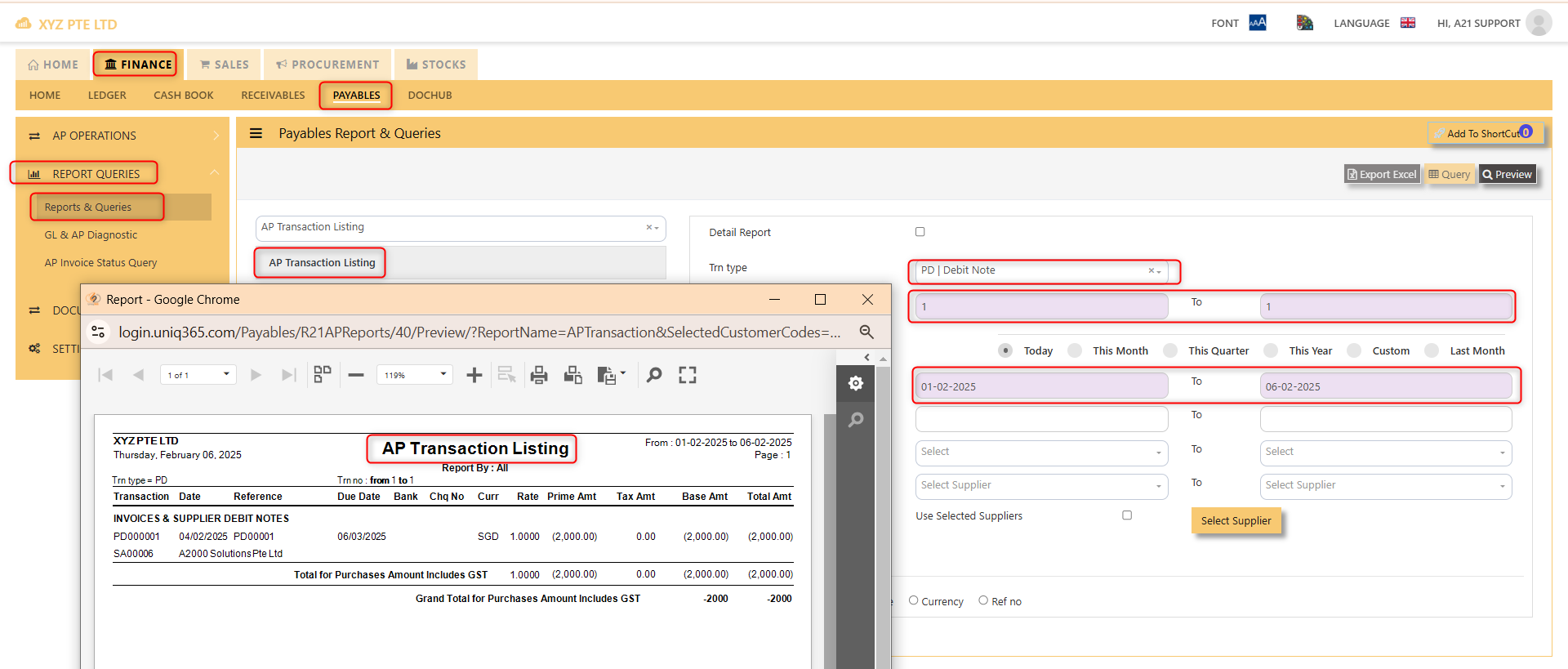

4. For the double entries of the PC transaction created, it can be verify under AP Transaction Listing.

Note: The steps to enter Credit Note (PC) & Debit Note (PD) are identical to PI. User will need to select transaction type PC or PD respectively to enter the record.

Supplier Invoice (AP)

How to enter Supplier Invoice (PI)?

A supplier invoice is a document issued by a supplier to a buyer requesting payment for goods or services provided. It typically includes details such as the quantity, price, and description of the items, along with payment terms and due dates. The invoice serves as a formal record of the transaction and is used for accounting and financial purposes.

There may be times where there is a purchase of non-stock item. User may use PI transaction to effect such transaction.

Steps to enter PI are as follow:

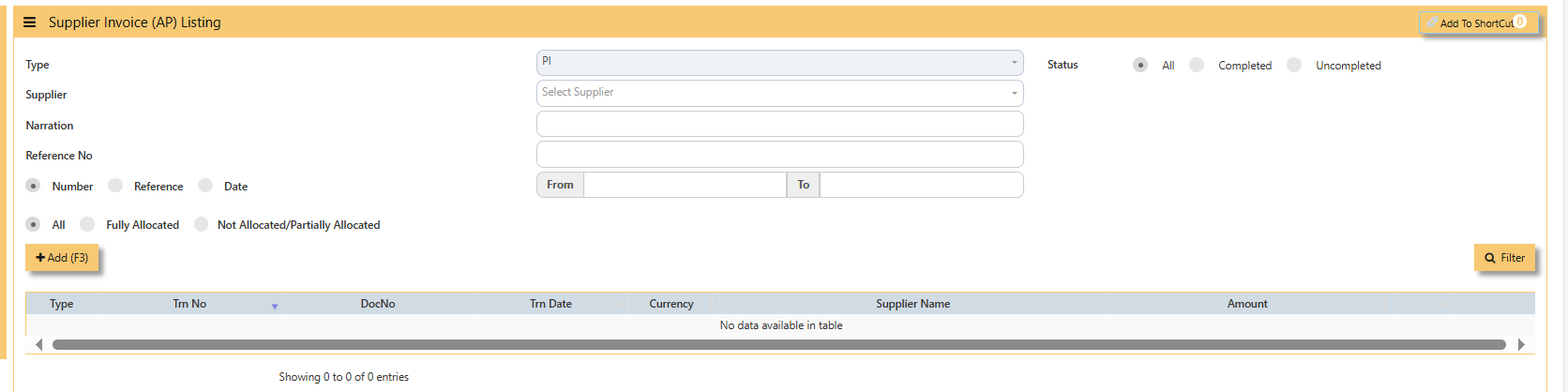

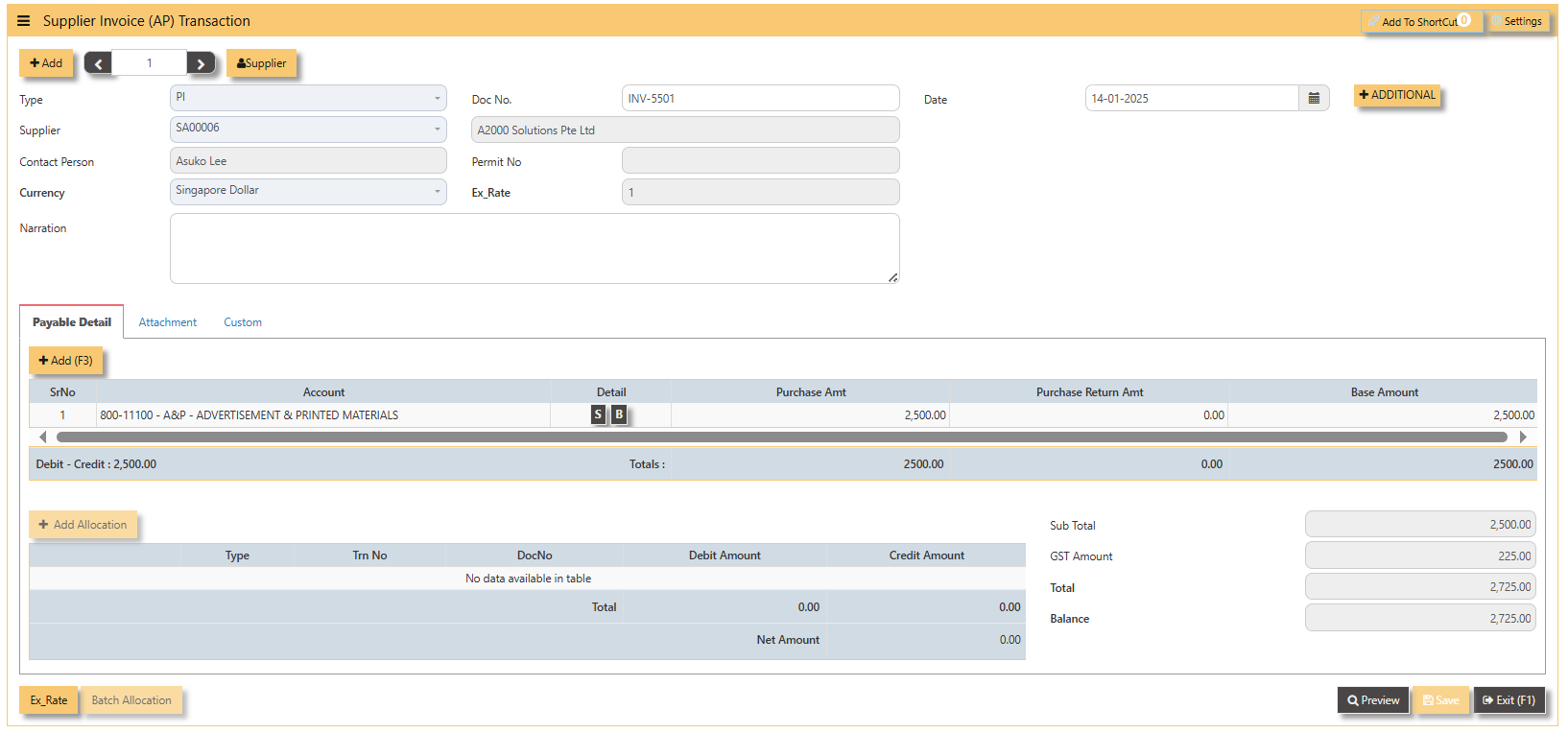

- Click on Payables – AP Operations – Supplier Invoice (AP) and the following screen will appear.

- Click on Add button to create a new transaction

- Fill up the fields in the header section such as Ref No, Date, Supplier, Contact Person, Currency and Exchange Rate.

- Then select the account concerned at the detail section.

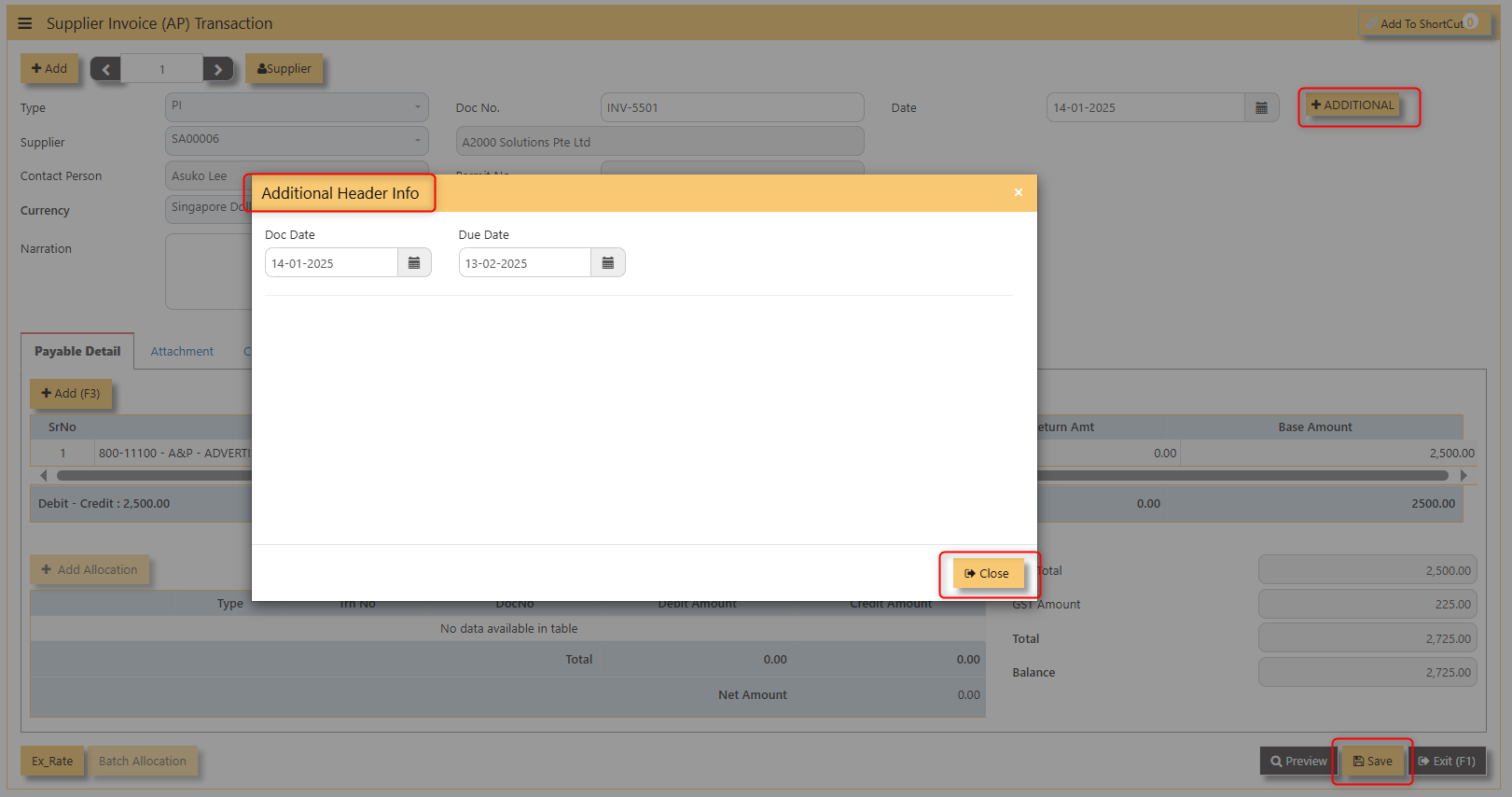

- Click for Additional Info for necessary details to add.

- Click on save button to complete the entry.

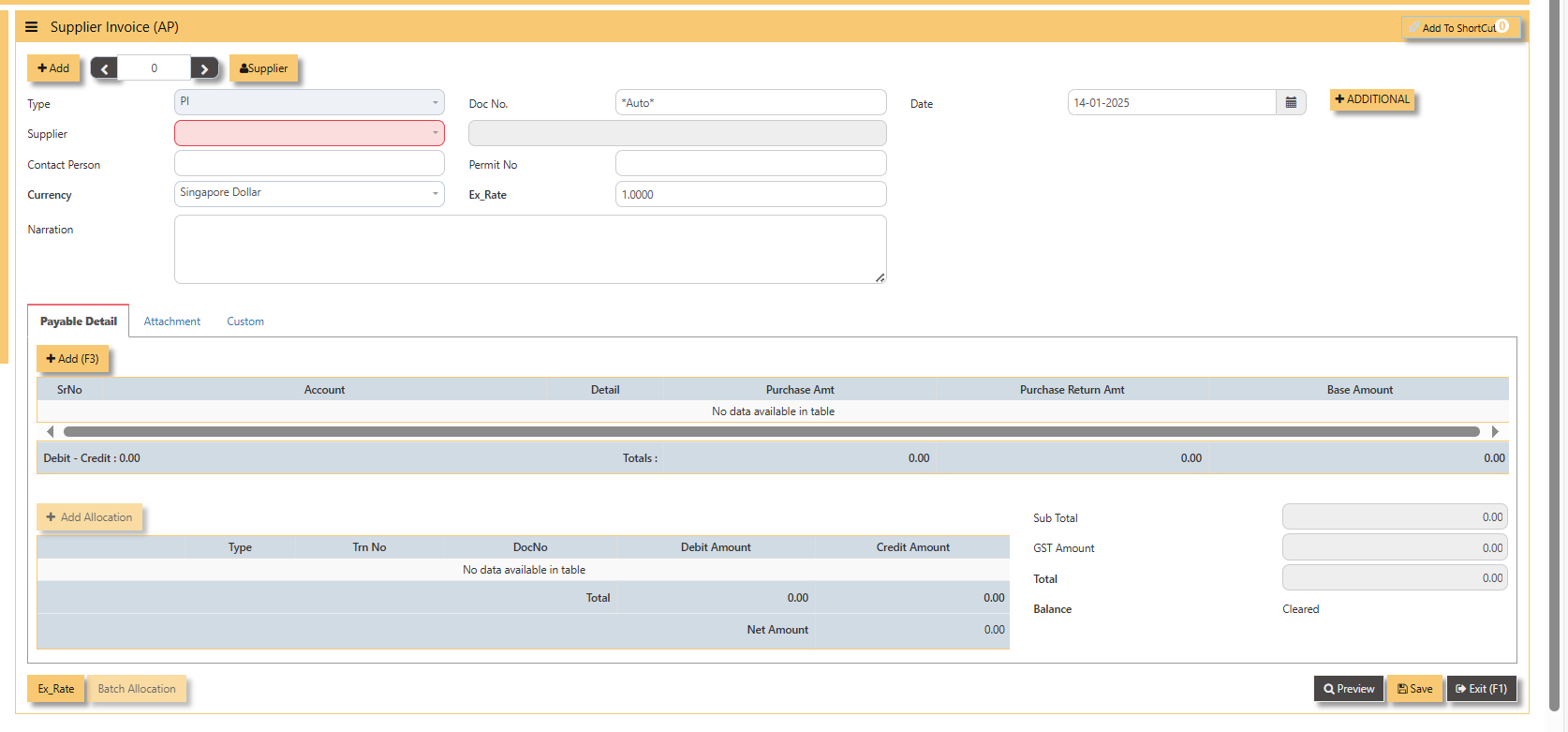

3. Below is a sample PI transaction screen.

Additional Information:

- Ex Rate It will redirect you to Finance Tab. Attached link for further information. MASTERS GL | Support Doc

3. For the entries of the PI transaction created, it can be verify under AP Transaction Listing.

Note: The steps to enter Credit Note (PC) & Debit Note (PD) are identical to PI. User will need to select transaction type PC or PD respectively to enter the record.

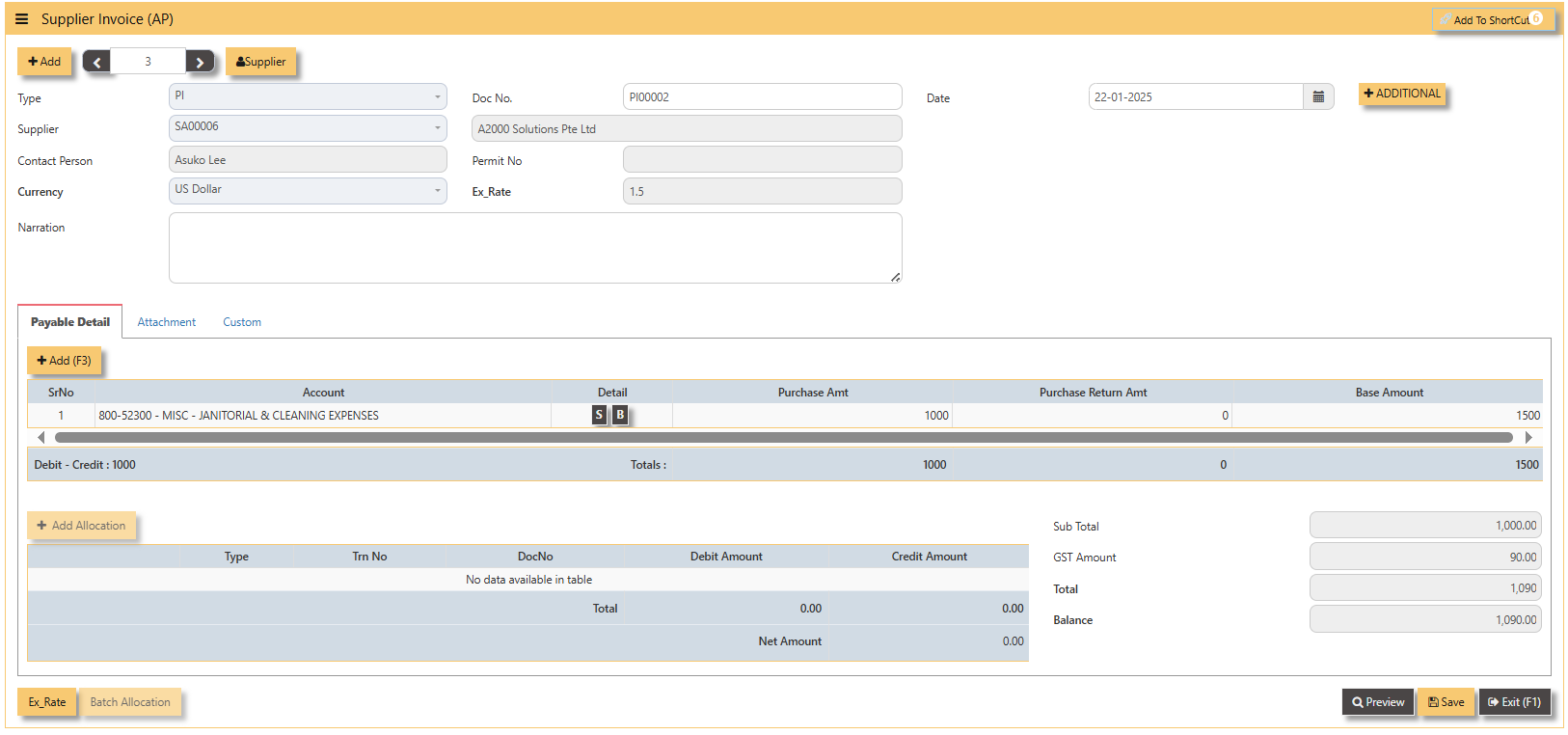

How to allocate Foreign Currency Invoice with Base Currency Payment?

Let's use the following example to do this type of allocation:

1. Create a foreign currency invoice as follow:

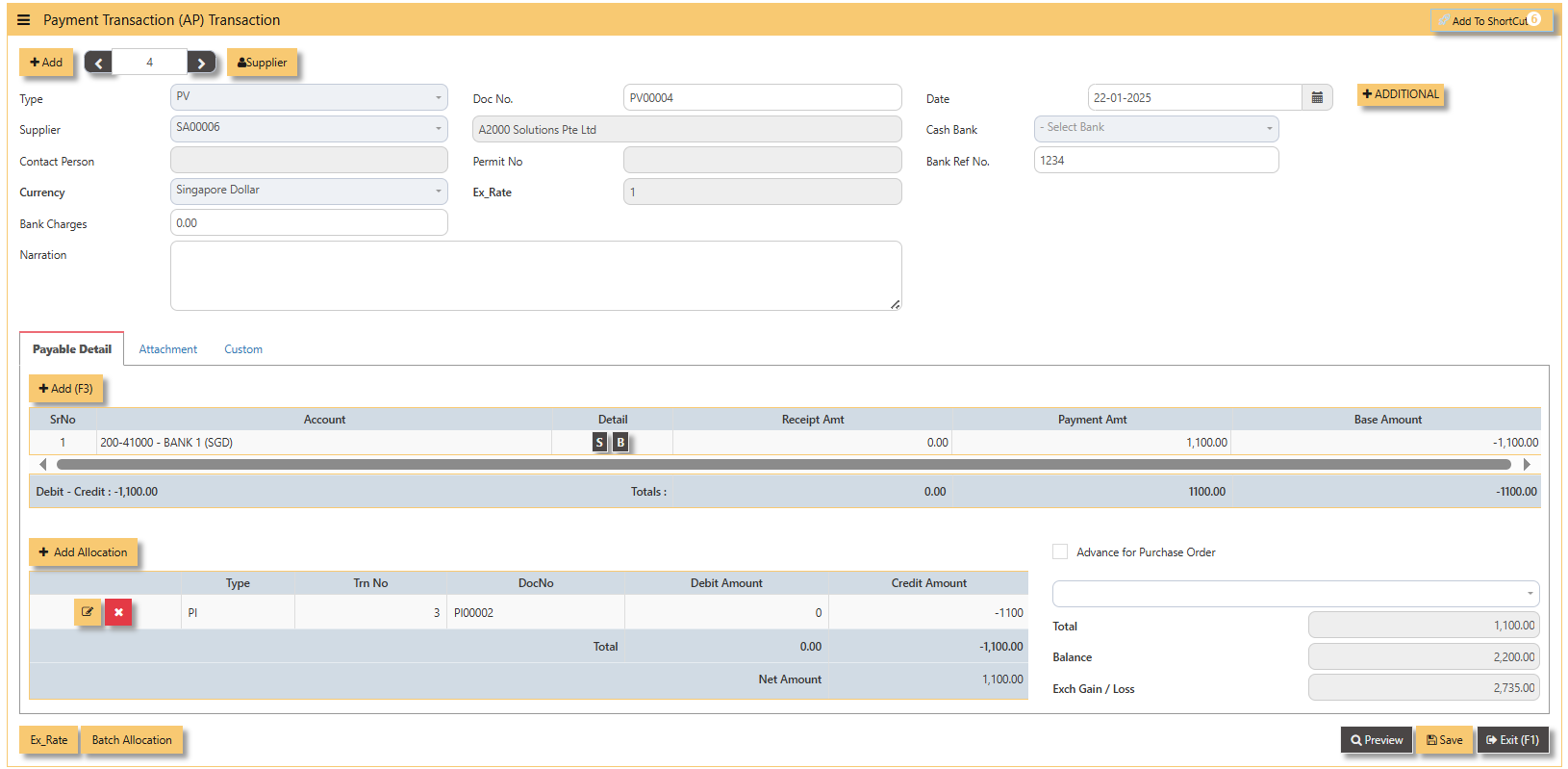

2. Payment is made in base currency and in this example, it is SGD. The payment voucher should be entered as follow:

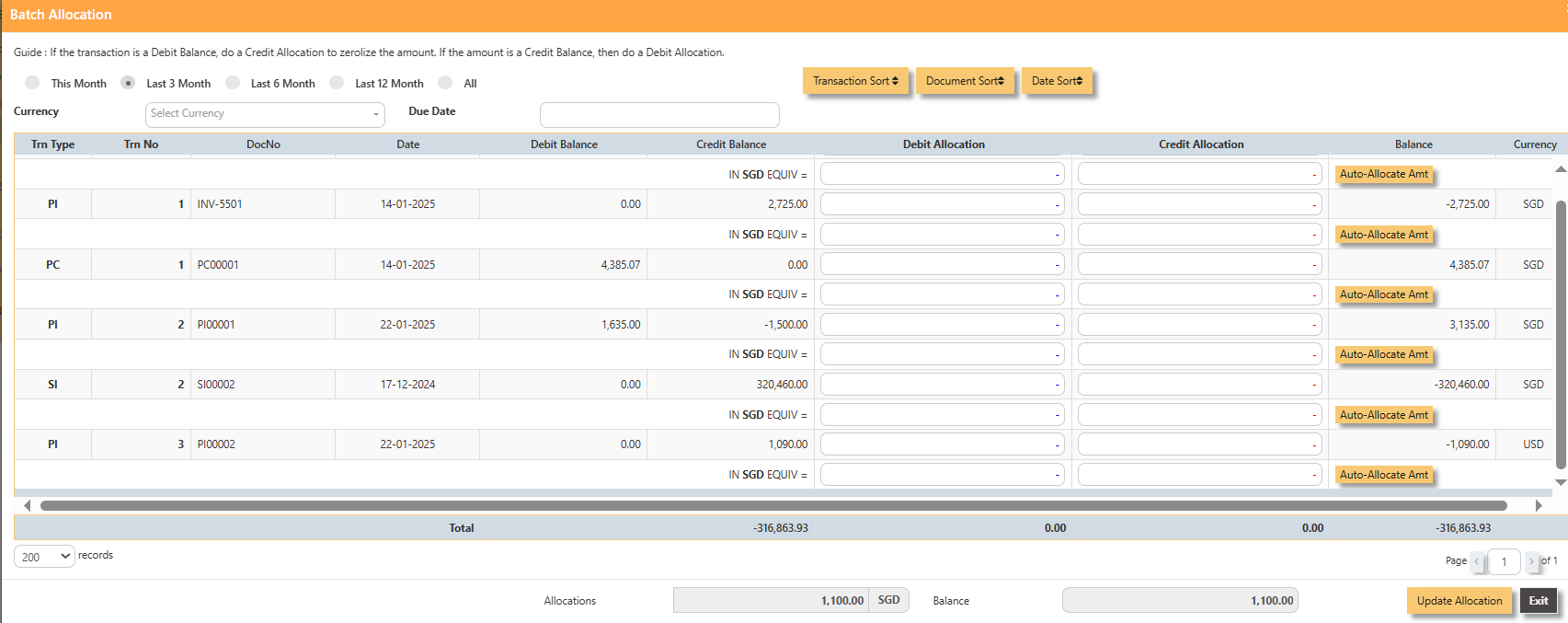

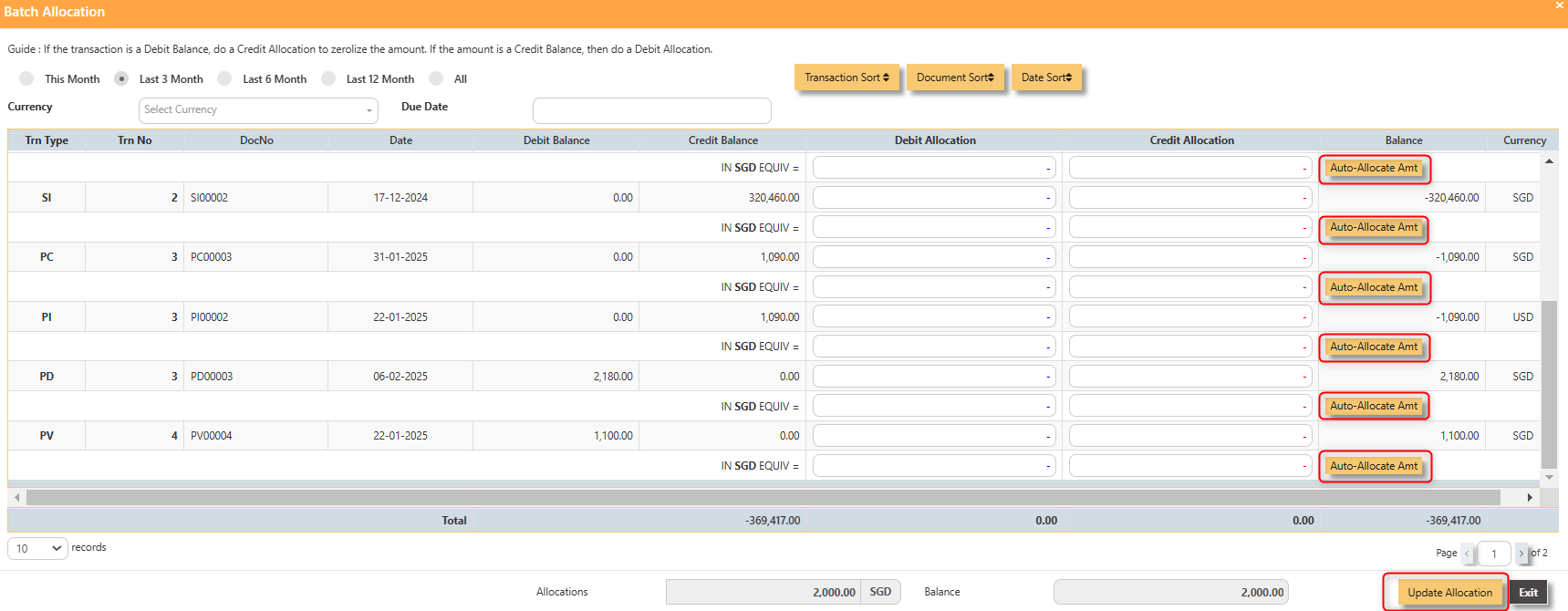

- Click on Batch Allocation button for the screen below:

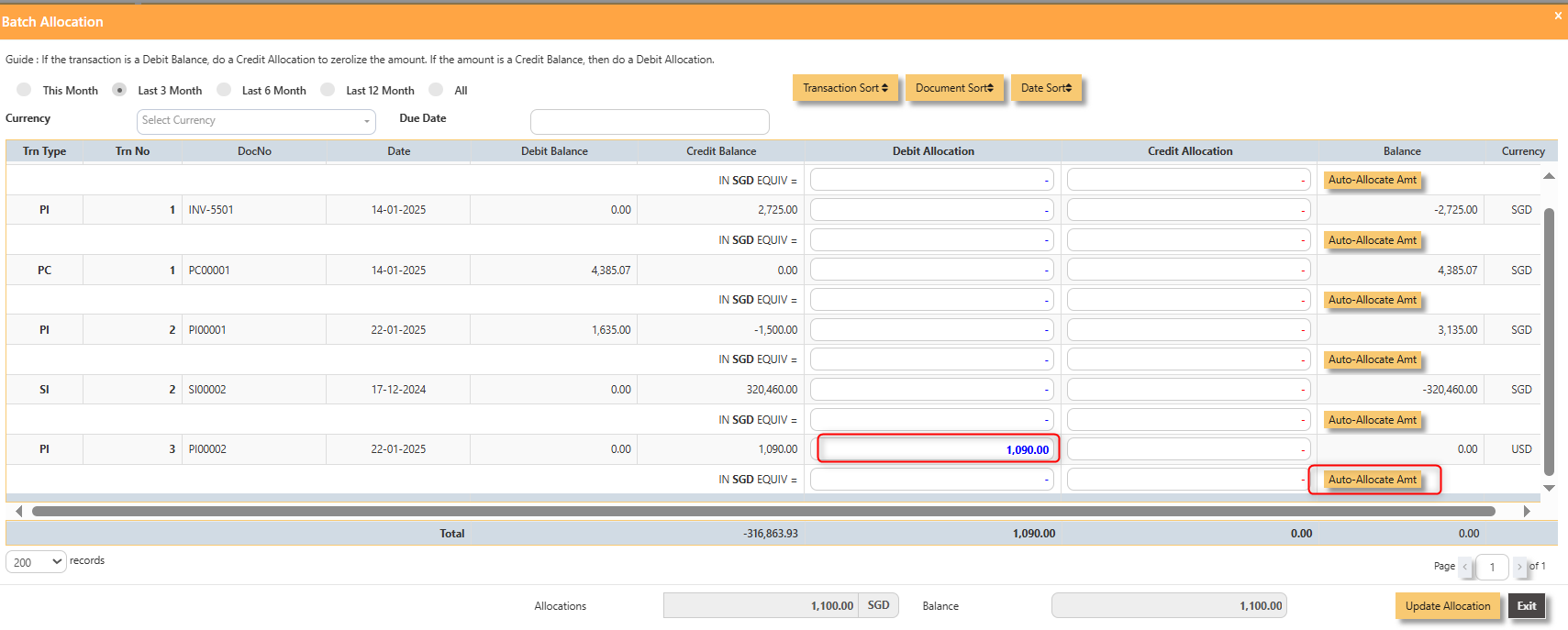

- For PI00002, click on Auto-Allocate Amt button, you will notice that the full amount of the invoice will be populated at

the 1st line.

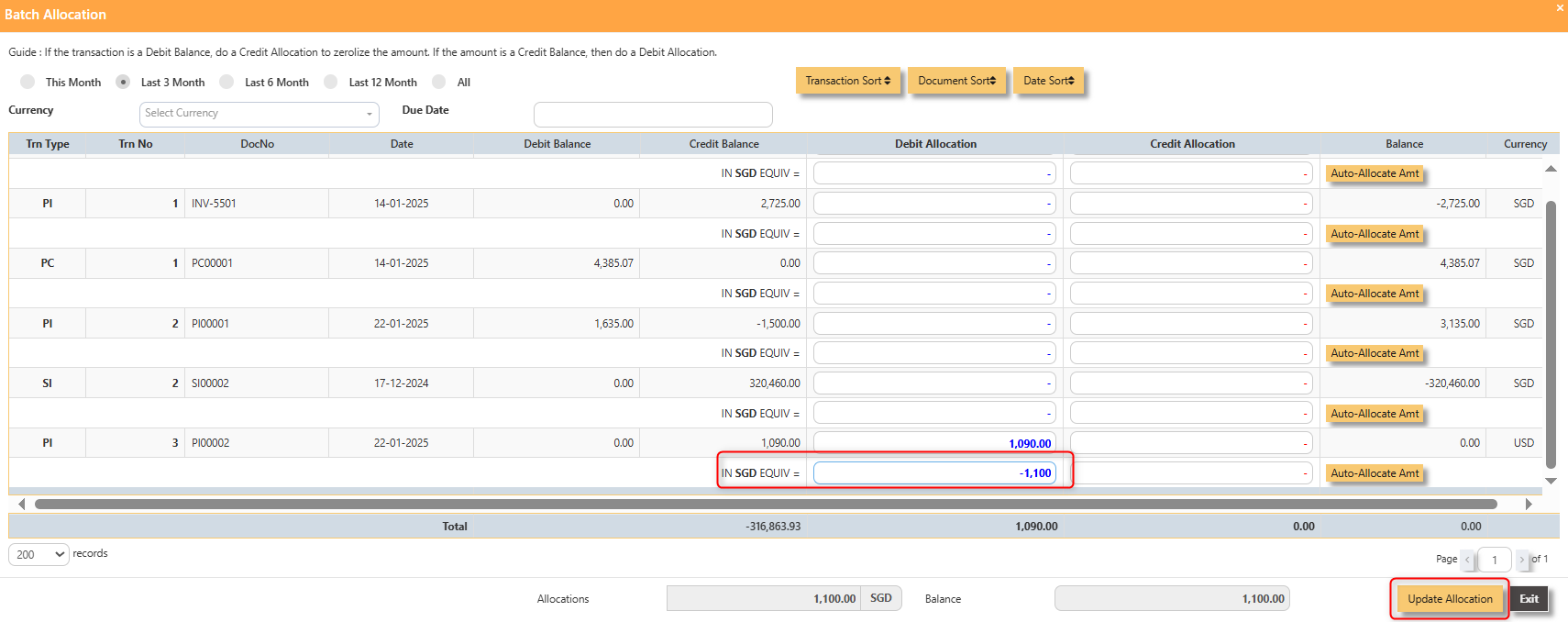

- You should manually type in the base currency amount in SGD field as shown below. Click on Update Allocation to complete the allocation and save the PV transaction.

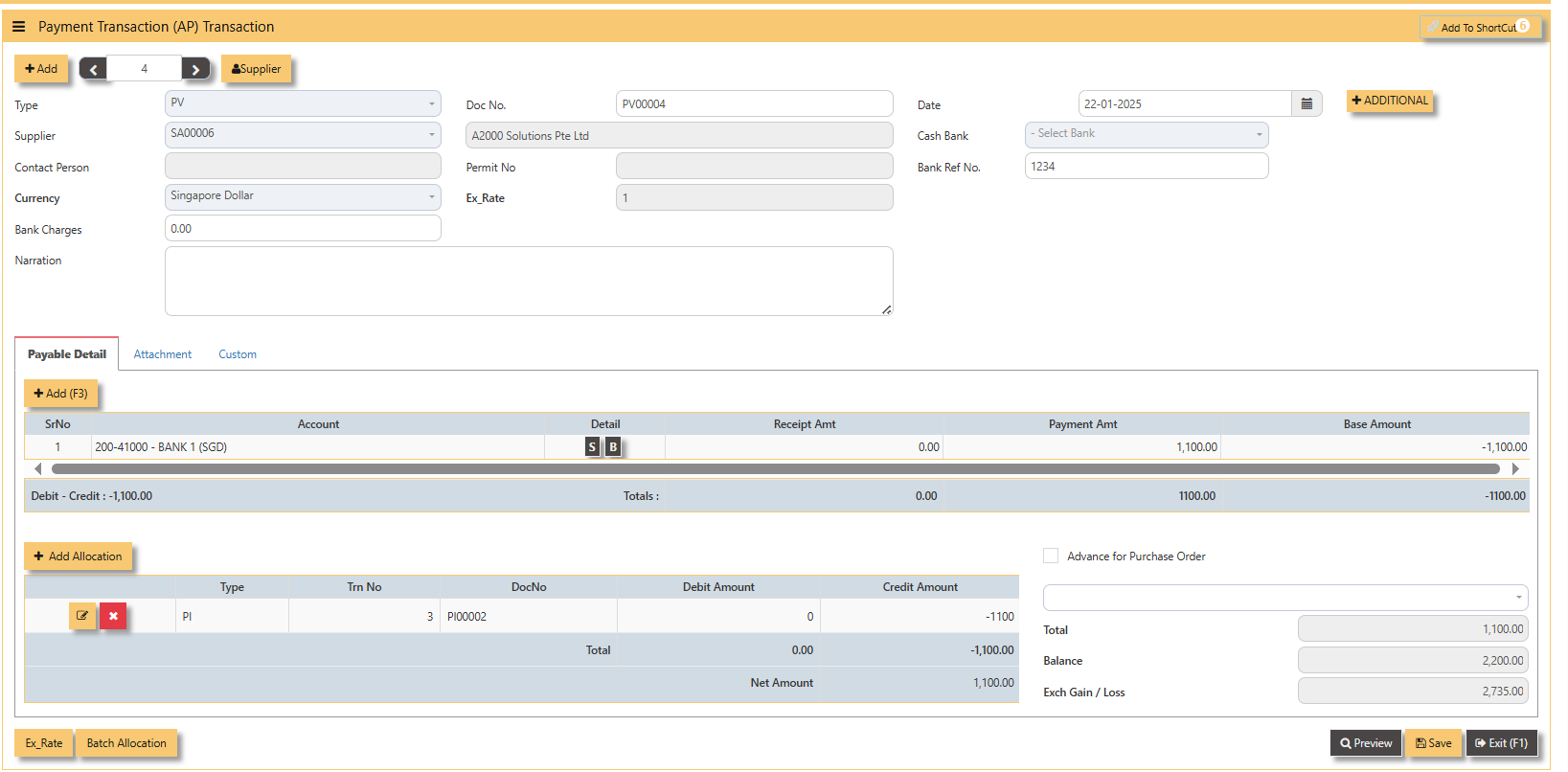

3. The completed payment transaction is as follow:

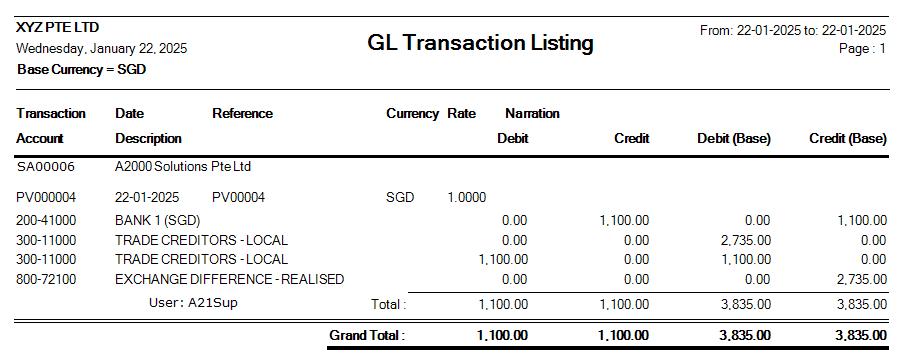

4. UNIQ365 will capture the Realized Exchange Gain/Loss automatically upon allocation. The double entry of the above

transaction is shown below:

Payment Transaction (AP)

How to enter Payment Transaction (PV)?

A payment transaction is the process where funds are transferred from one party to another in exchange for goods, services, or obligations. It typically involves the payer providing payment information, which is then processed by a payment system or intermediary. Once the transaction is authorized, the funds are transferred to the payee, completing the exchange.

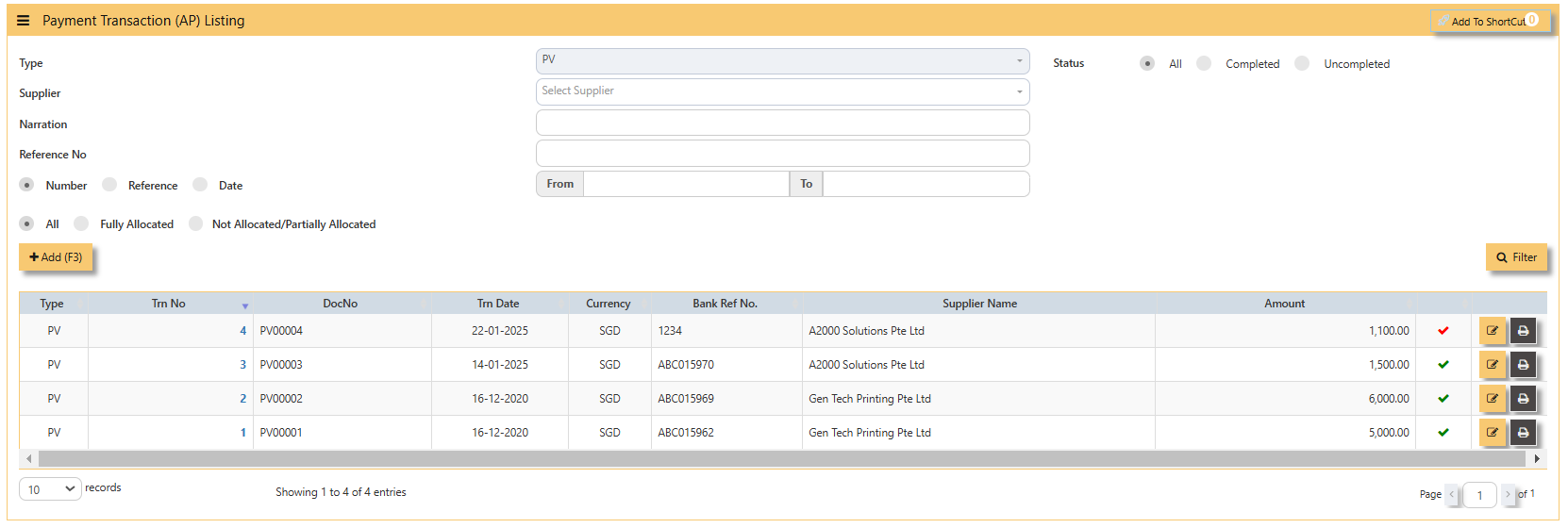

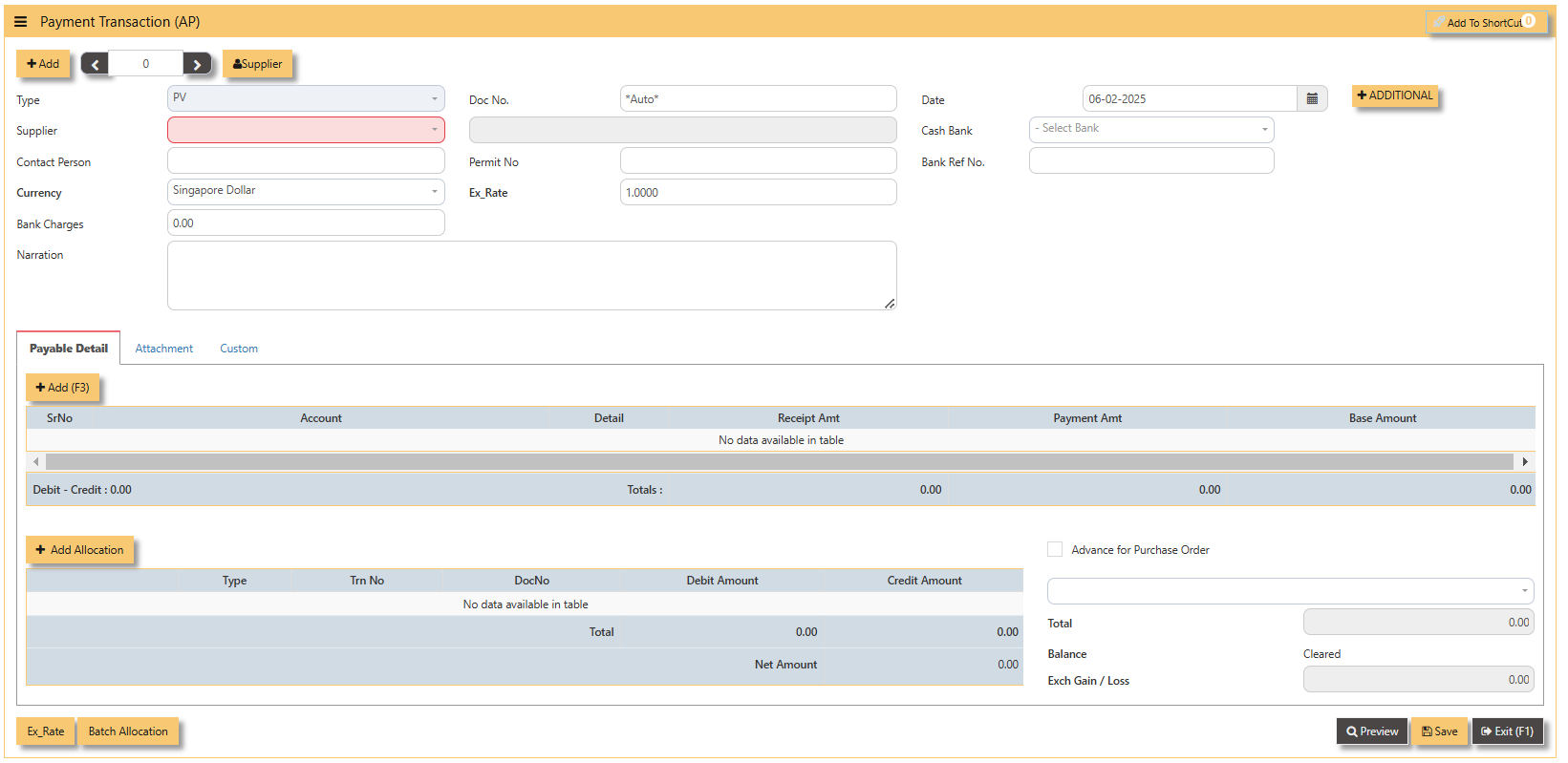

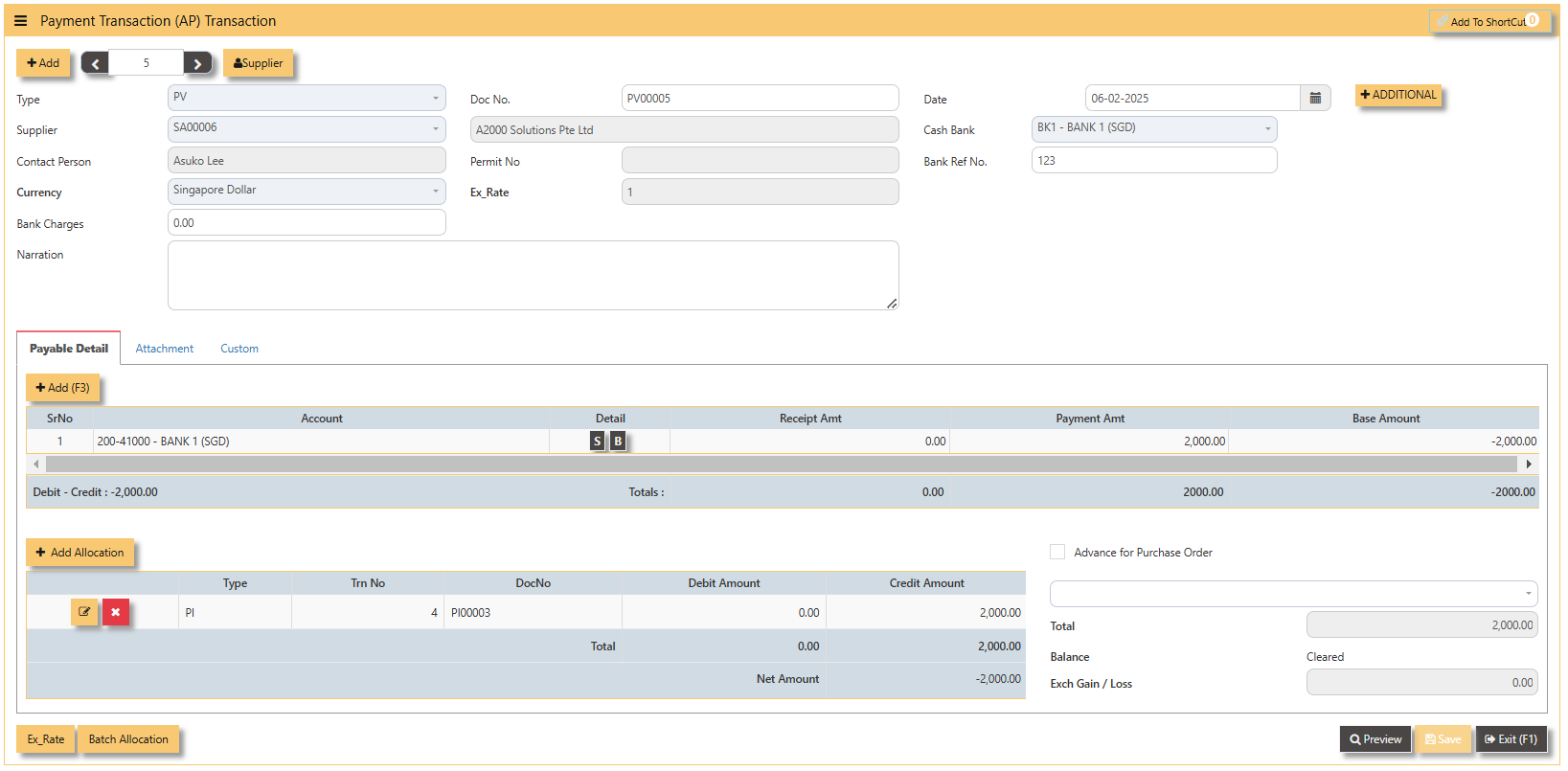

Steps to enter PV are as follow:

- Click on Payables – AP Operations – Payment Transaction (AP) and the following screen will appear.

2. Click on Add button to create a new transaction.

- Fill up the fields in the header section such as Date, Supplier, Contact Person, Currency, Exchange Rate, Cash Bank and Bank Ref No.

- Then select the account concerned at the detail section.

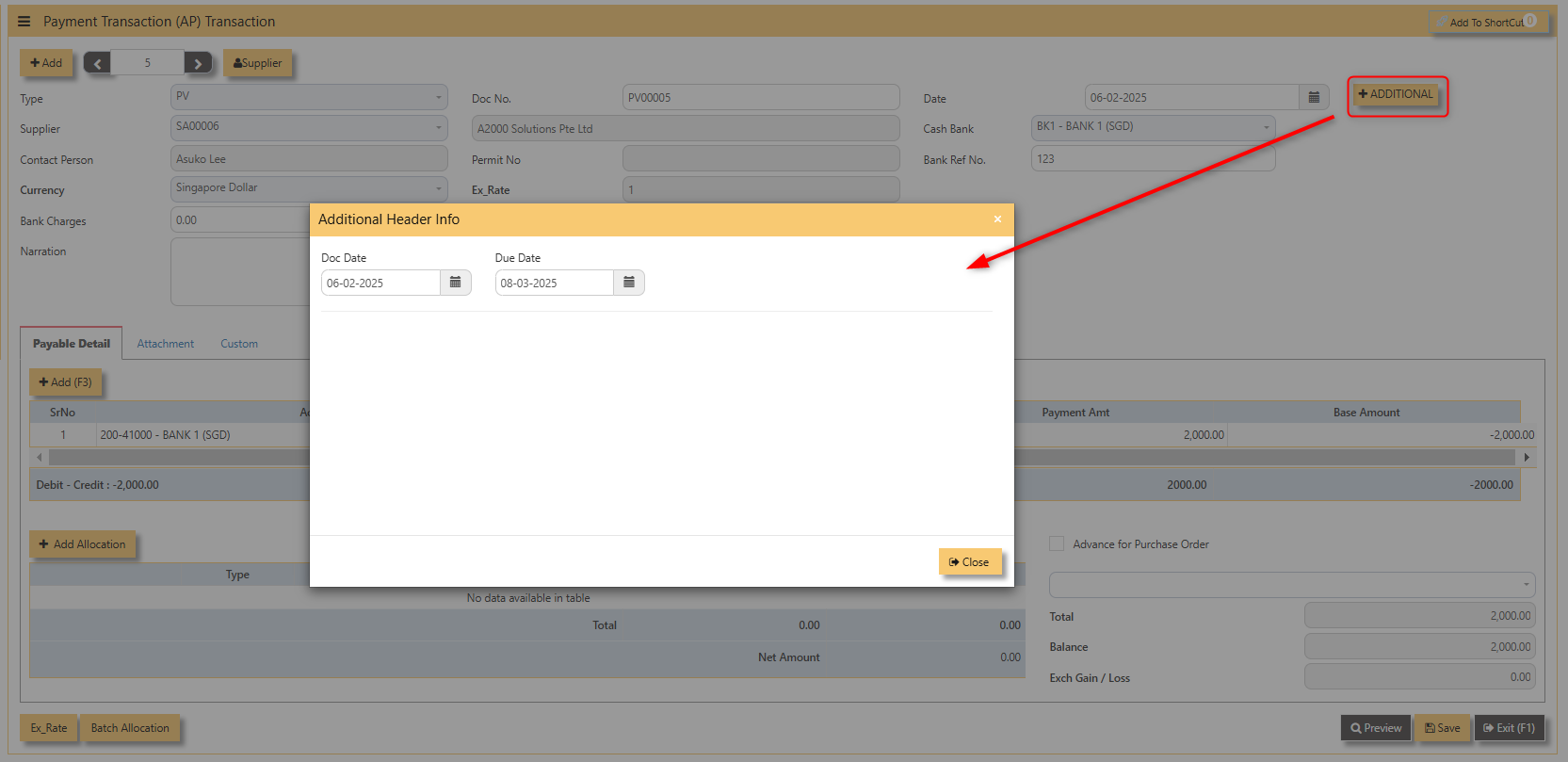

- Click for Additional Info for necessary details to add.

- Click on save button to complete the entry.

3. Below is a sample PV transaction screen.

Additional Information:

- Ex Rate It will redirect you to Finance Tab. Attached link for further information. MASTERS GL | Support Doc

- Batch Allocation If you have a lot of transactions needed to allocate, you may use the batch allocation button to allocate transactions in a convenient way. Sample below.

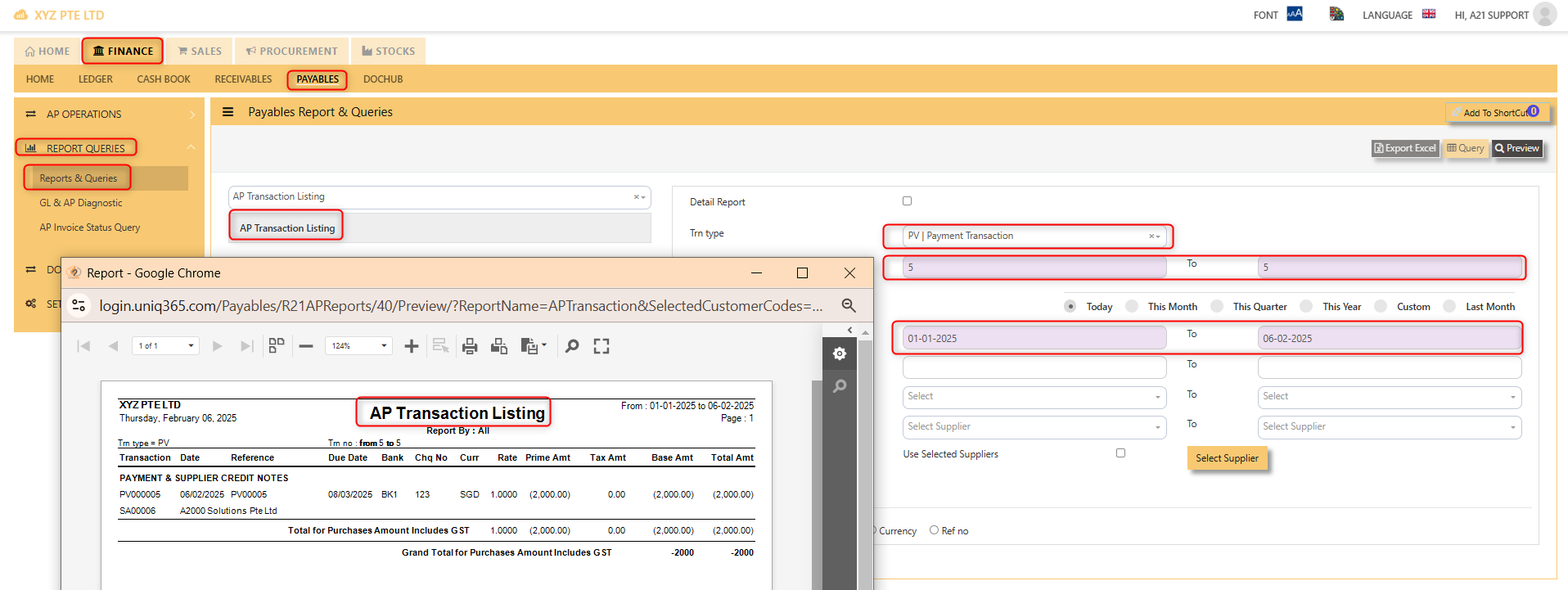

4. For the double entries of the PV transaction created, it can be verify under AP Transaction Listing.

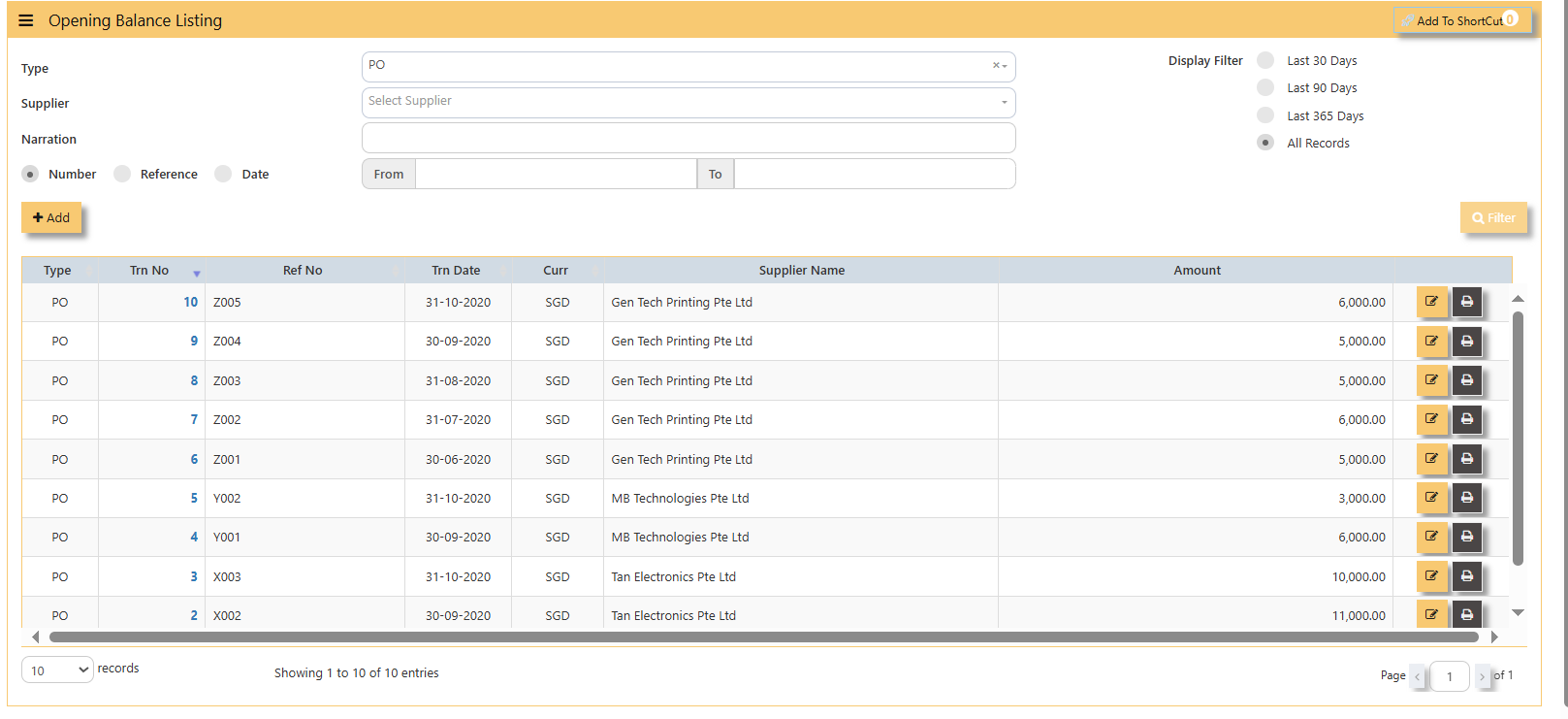

Opening Balance

To start on a new database, AP Opening Balances must be updated in order for user to trace all the outstanding supplier invoices at the start of the 1st financial year.

Important: The total amount entered under AP Open Item must tie with the opening amount in the General Ledger Opening for Trade Creditor Control Account/(s) if the Posting Type selected in Payable Control Account is Supplier.

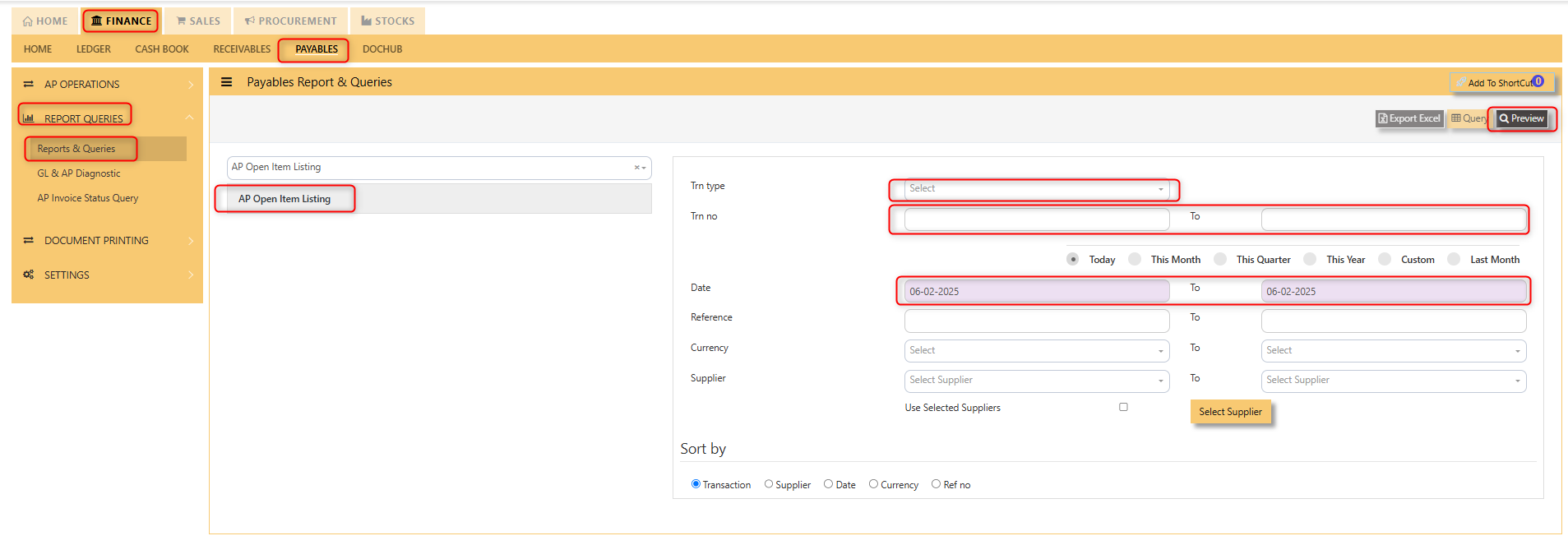

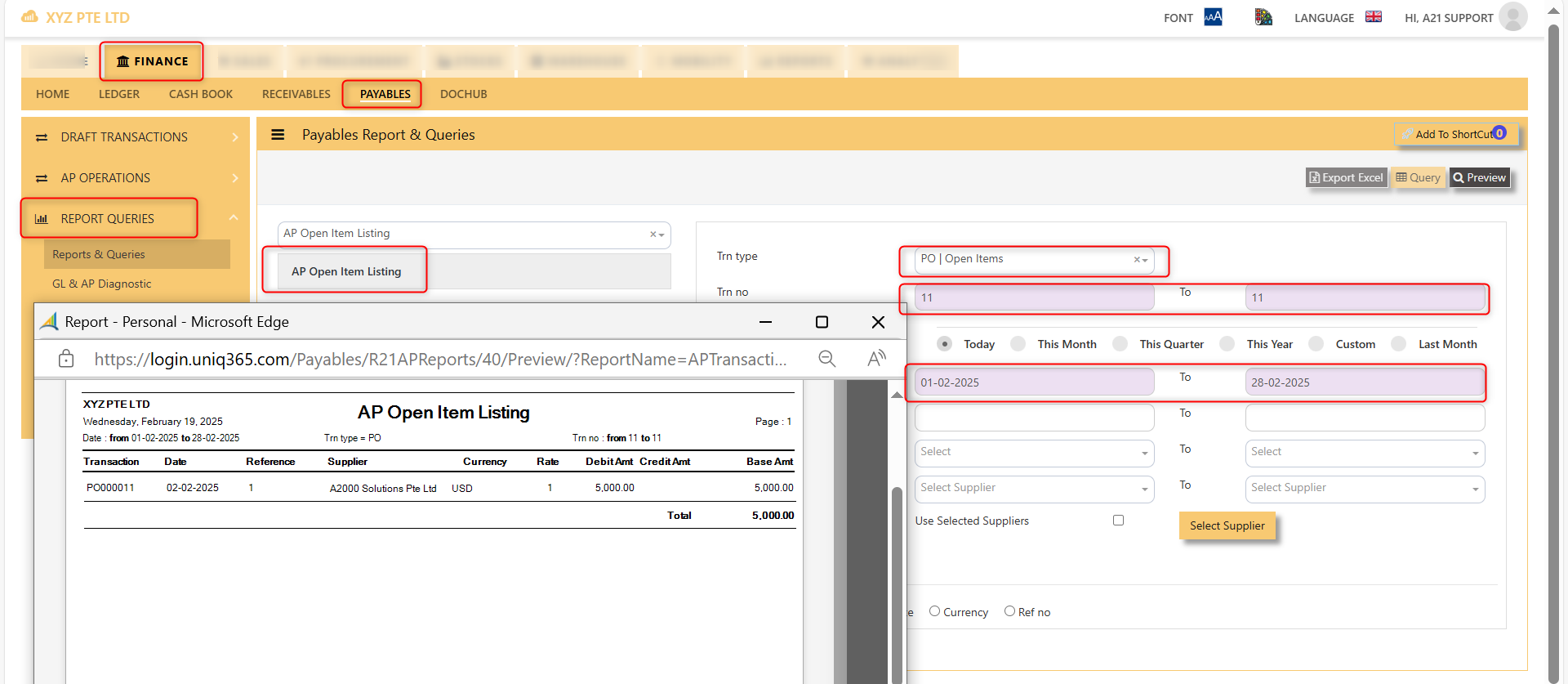

You may use the report under Payables – Reports & Queries – AP Open Item Listings to tie the figures.

Below is the Account Payable – Opening Items screen. There is NO double entry posting for this option. The records entered will be retained for current year usage like allocations, verification of outstanding invoices etc.

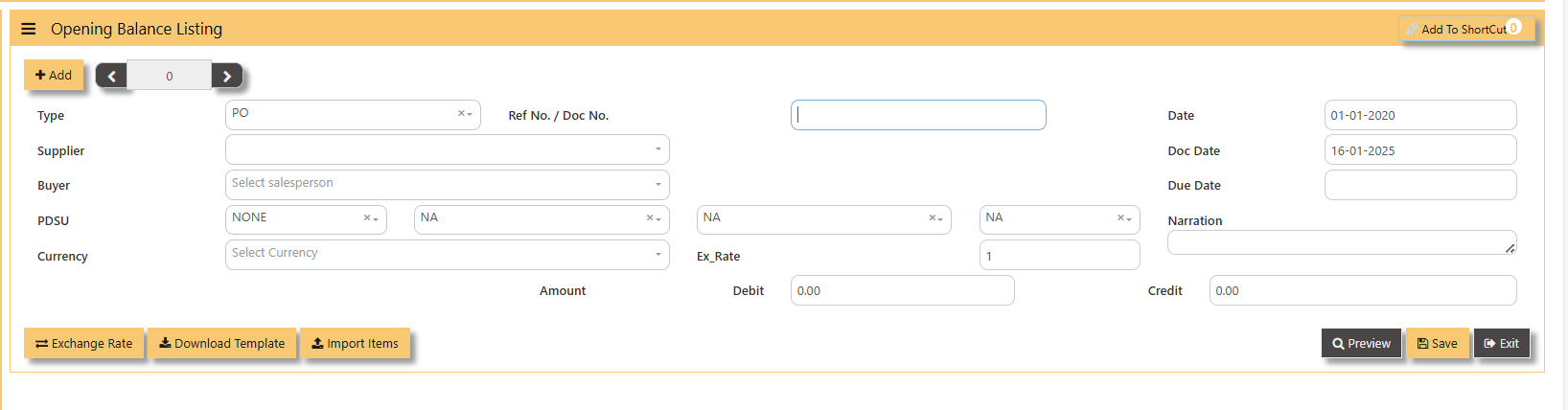

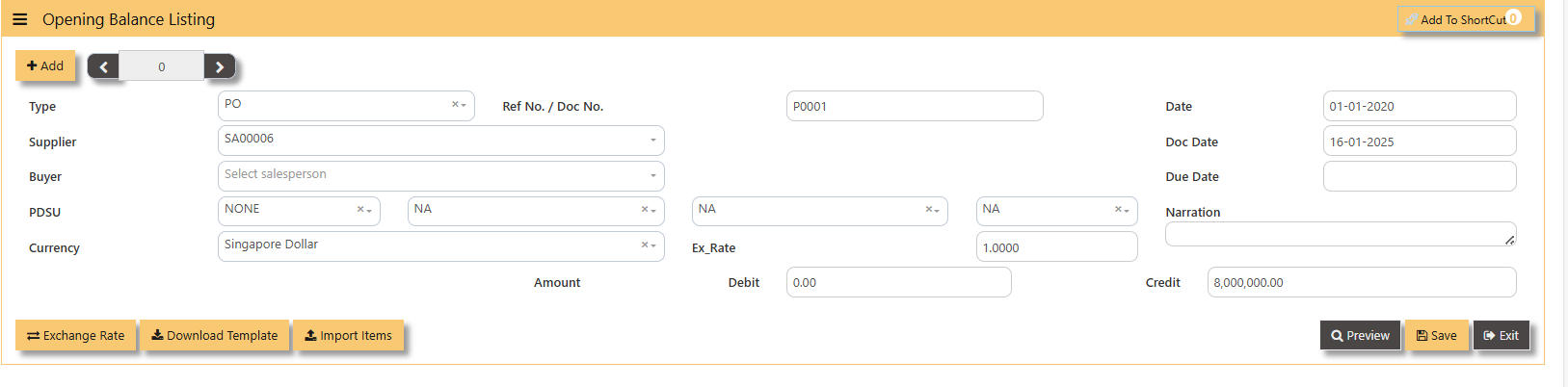

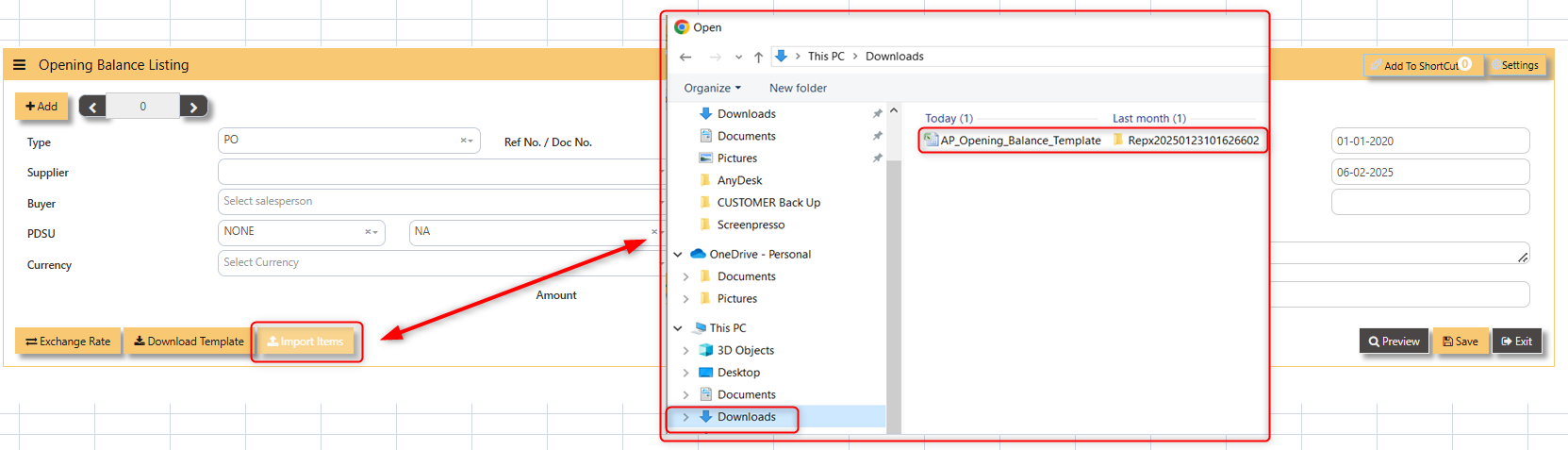

1. Click on Payables – AP Operations – Opening Balance and the following screen will appear.

- Fill up the fields such as Ref No, Date, Dock Date, Due Date, Supplier, Buyer, PDSU, Currency, Exchange Rate, Narration, and amount.

Note: The date must be the actual date of invoices concerned in order for the system to capture the correct supplier aging. If supplier invoice the amount is credit side and if is a supplier credit note is a debit side.

Additional Information:

- Ex Rate It will redirect you to Finance Tab. Attached link for further information. MASTERS GL | Support Doc

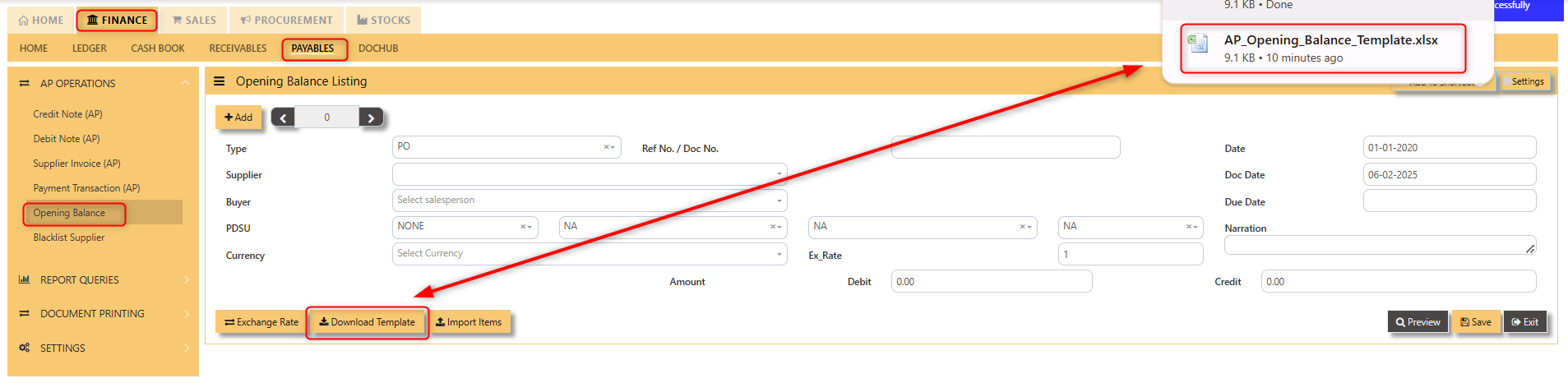

- Download Template Once you click for the Download Template, it will auto download the Excel File.

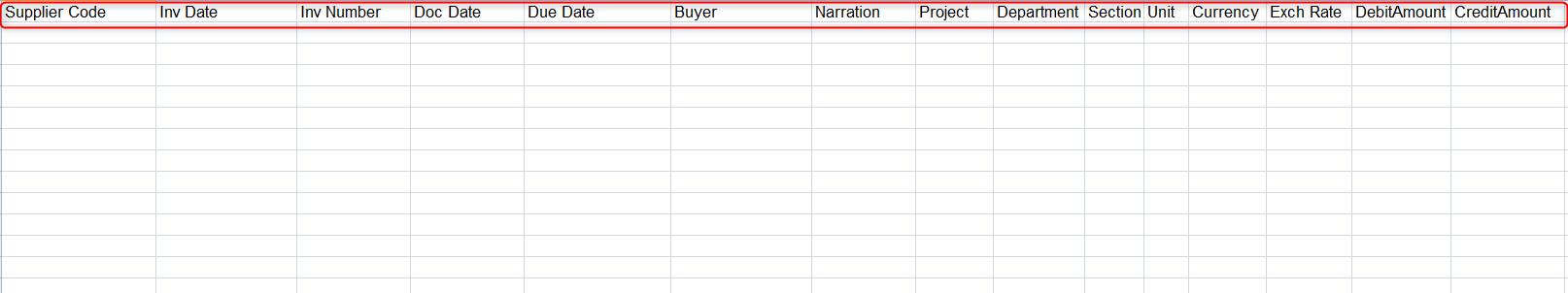

Ensure the Excel file you plan to upload is formatted correctly. It should contain all these fields:

- Supplier Code

- Inv Date

- Inv Number

- Doc Date

- Due Date

- Buyer

- Narration

- Project

- Department

- Section

- Unit

- Currency

- Exchange Rate

- Debit Amount

- Credit Amount

How to Import Items?

1. Click Import Items, this opens a file browser or prompt you to select the Excel file you want to upload.

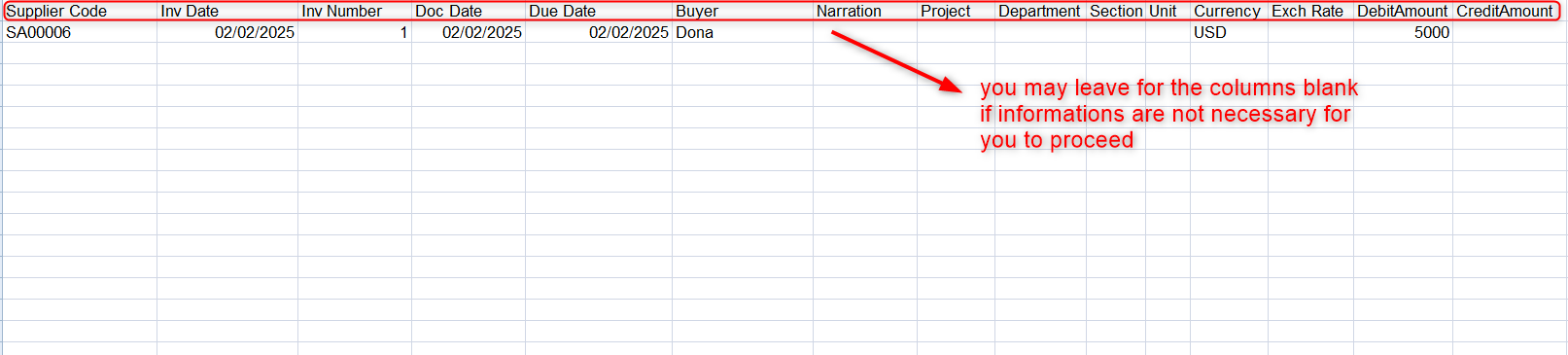

- Sample excel file below generated from the system,

2. After successfully import of the excel file above, you may verify the entry in AP Open Item Listing,

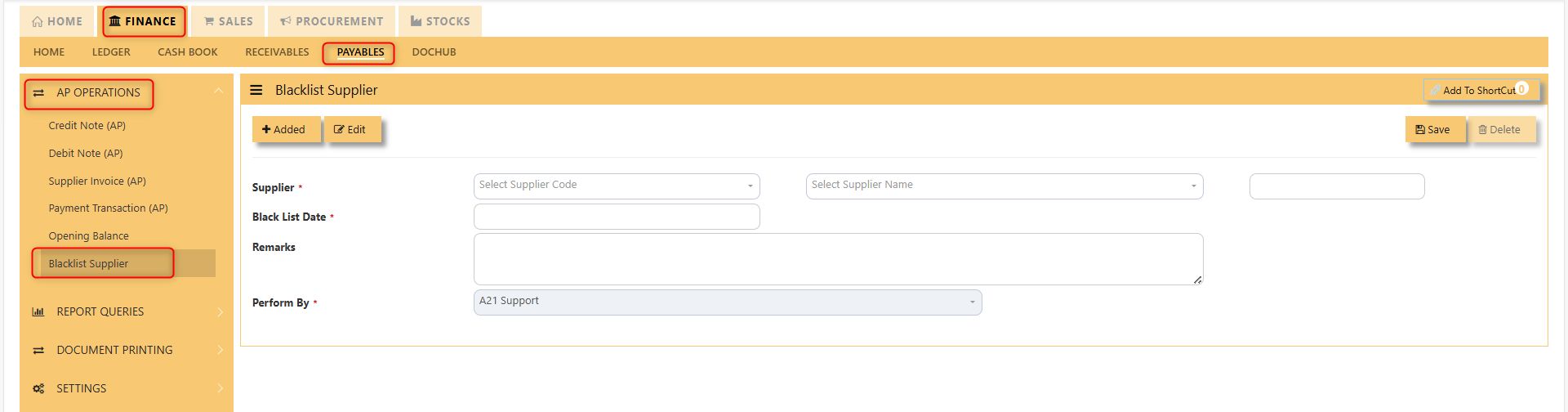

Blacklist Supplier

This option enables user to blacklist customers and suppliers. Once a supplier is black-listed, user will be blocked from entering any purchase transactions for the supplier concerned.

How to enter Blacklist Supplier?

Steps to enter Blacklist Supplier are as follow:

1. Click on Payables – AP Operations – Blacklist Supplier for the entry screen.

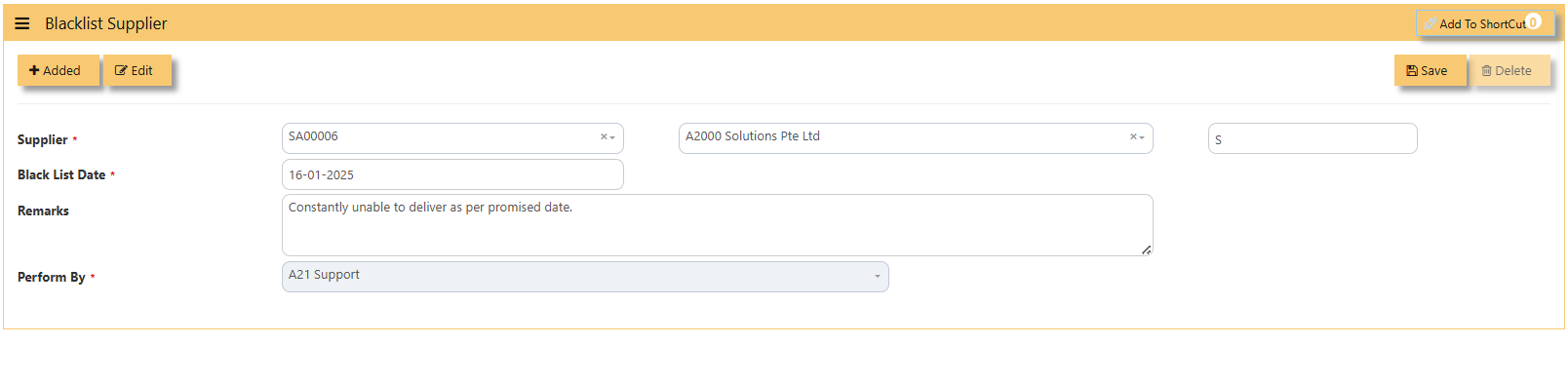

2. Click on Add button. Select the supplier from the drop-down list, enter the Blacklist date, key in the Remarks and select the A2000ERP user who performed the entry.

Screen below is an example of the entry.

- To delete a supplier from the blacklist record, user must click on Edit button, select the supplier concerned, and then click

on Delete button to clear the record. - User may print the report of all the Blacklisted Suppliers for reference via Payables – Reports & Queries – Blacklisted

Supplier Listing.